Sponsor Area

Accounting For Partnership:Basic Concepts

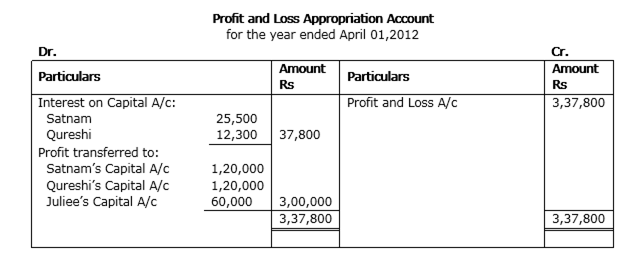

Satnam and Qureshi after doing their MBA decided to start a partnership firm to manufacture ISI marked electronic goods for economically weaker section of the society. Satnam also expressed his willingness to admit Juliee as partner without capital who is especially abled but a very creative and intelligent friend of him. Qureshi agreed to this. They formed a partnership on 1st April 2012 on the following terms:

(i) Satnam will contribute Rs 4,00,000 and Qureshi will contribute Rs 2,00,000 as capitals.

(ii) Satnam, Qureshi and Juliee will share profits in the ratio of 2:2:1.

(iii) Interest on capital will be allowed @ 6% p.a. Due to shortage of capital Satnam contributed Rs 50,000 on 30th September, 2012 and Qureshi contributed Rs 20,000 on 1st January, 2013 as additional capitals. The profit of the firm for the year ended 31st March, 2013 was Rs 3,37,800.

(a) Identify any two values which the firm wants to communicate to the society.

(b) Prepare Profit & Loss Appropriation Account for the year ending 31st March, 2013.

(a) Values:

1) Devotion to law, to manufacture ISI marked goods.

2) Sensitivity towards especially abled people.

(b)

Working Notes:

Calculation of Interest on Capital:

a) Interest on Satnam’s capital:

On Initial capital of Rs 4,00,000

4,00,000* 6% = 24,000

On additional capital of Rs 50,000

50,000* 6% * 6/12 = 1500

Total interest on Satnam’s capital = 24000 + 1500 = Rs 25,500.

b) Interest on Qureshi’s Capital:

On initial capital of Rs 2,00,000

2,00,000* 6% = Rs 12,000

On additional capital of Rs 20,000

20,000 * 6% * 3/12 = Rs 300

Total interest on Qureshi’s Capital = 12,300

Some More Questions From Accounting for Partnership:Basic Concepts Chapter

Ali, Bimal and Deepak are partners in a firm. On 1st April, 2011 their capital accounts stood at Rs. 4,00,000, Rs. 3,00,000 and Rs. 2,00,000 respectively. They shared profits and losses in the proportion of 5:3:2. Partners are entitled to interest on capital @ 10% per annum and salary to Bimal and Deepak @ 2,000 per month and Rs. 3,000 per quarter respectively as per the provisions of the partnership deed.

Bimal's share of profit (excluding interest on capital but including salary) is guaranteed at a minimum of Rs. 50,000 p.a. Any deficiency arising on that account shall be met by Deepak. The profits of the firm for the year ended 31st March, 2012 amounted to Rs. 2,00,000. Prepare Profit & Loss Account for the year ended on 31st March, 2012.

Bimal's share of profit (excluding interest on capital but including salary) is guaranteed at a minimum of Rs. 50,000 p.a. Any deficiency arising on that account shall be met by Deepak. The profits of the firm for the year ended 31st March, 2012 amounted to Rs. 2,00,000. Prepare Profit & Loss Account for the year ended on 31st March, 2012.

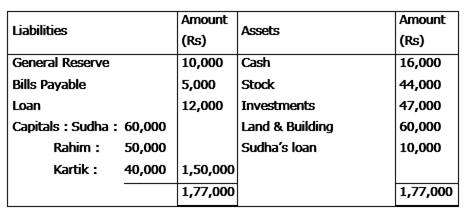

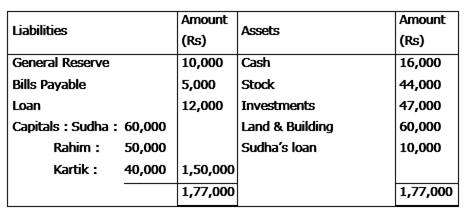

The Balance Sheet of Sudha, Rahim and Kartik who were sharing profit in the ratio of 3:3 4 as on 31st March, 2012 was as follows:

Sudha died on June 30th 2012. The partnership deed provided for the following on the death of a partner:

(a) Goodwill of the firm be valued at two years purchase of average profits for the last three years.

(b) Sudha’s share of profit or loss till the date of her death was to be calculated on the basis of sales. Sales for the year ended 31st March, 2012 amounted to Rs 4,00,000 and that from 1stApril to 30th June 2012 to Rs 1,50,000. The profit for the year ended 31st March, 2012 was Rs 1,00,000.

(c) Interest on capital was to be provided @ 6% p.a.

(d) The average profits of the last three years were Rs 42,000.

(e) According to Sudha’s will, the executors should donate her share to Matri Chhaya an orphanage for girls.

Prepare Sudha’s Capital Account to be rendered to her executor. Also identify the value being highlighted in the question.

(b) Sudha’s share of profit or loss till the date of her death was to be calculated on the basis of sales. Sales for the year ended 31st March, 2012 amounted to Rs 4,00,000 and that from 1stApril to 30th June 2012 to Rs 1,50,000. The profit for the year ended 31st March, 2012 was Rs 1,00,000.

(c) Interest on capital was to be provided @ 6% p.a.

(d) The average profits of the last three years were Rs 42,000.

(e) According to Sudha’s will, the executors should donate her share to Matri Chhaya an orphanage for girls.

Prepare Sudha’s Capital Account to be rendered to her executor. Also identify the value being highlighted in the question.

State the provisions of Indian Partnership Act regarding the payment of remuneration to a partner for the services rendered.

Arun and Arora were partners in a firm sharing profits in the ratio of 5:3. Their fixed capitals on 1-4-2010 were: Arun Rs 60,000 and Arora Rs 80,000. They agreed to allow interest on capital @ 12% p.a. And to charge on drawings @ 15% p.a. The profit of the firm for the year ended 31-3 2011 before all above adjustments were Rs 12,600. The drawings made by Arun were Rs 2,000 and by Arora Rs 4,000 during the year. Prepare Profit and Loss Appropriation Account of Arun and Arora. Show your calculations clearly. The interest on capital will be allowed even if the firm incurs loss.

B and C were partners sharing profits in the ratio of 3 : 2. Their Balance Sheet as on 31-3-2011 was as follows:

Balance Sheet of B and C

as on 31-3-2011

Liabilities

Amount

Rs

Assets

Amount

Rs

Capital:

Land and Building

80,000

B

60,000

Machinery

20,000

C

40,000

1,00,000

Furniture

10,000

Debtors

25,000

Provision for bad debts

1,000

Cash

16,000

Creditors

60,000

Profit and Loss Account

10,000

1,61,000

1,61,000

D was admitted to the partnership for 1/5th share in the profits on the following terms:

(i) The new profit sharing ratio was decided as 2:2:1.

(ii) D will bring Rs 30,000 as his capital and Rs 15,000 for his share of goodwill.

(iii) Half of goodwill amount was withdrawn by the partner who sacrificed his share of profit in favour of D.

(iv) A provision of 5% for bad and doubtful debts was to be maintained.

(v) An item of Rs 500 included in Sundry Creditors was not likely to be paid.

(vi) An provision of Rs 800 was to be made for claims for damages against the firm.

After making the above adjustments the Capital Accounts of B and C were to be adjusted on the basis of D Capital. Actual cash was to be brought in or to be paid off as the case may be.

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of the new firm.

Balance Sheet of B and C

as on 31-3-2011

Liabilities

Amount

Rs

Assets

Amount

Rs

Capital:

Land and Building

80,000

B

60,000

Machinery

20,000

C

40,000

1,00,000

Furniture

10,000

Debtors

25,000

Provision for bad debts

1,000

Cash

16,000

Creditors

60,000

Profit and Loss Account

10,000

1,61,000

1,61,000

(i) The new profit sharing ratio was decided as 2:2:1.

(ii) D will bring Rs 30,000 as his capital and Rs 15,000 for his share of goodwill.

(iii) Half of goodwill amount was withdrawn by the partner who sacrificed his share of profit in favour of D.

(iv) A provision of 5% for bad and doubtful debts was to be maintained.

(v) An item of Rs 500 included in Sundry Creditors was not likely to be paid.

(vi) An provision of Rs 800 was to be made for claims for damages against the firm.

After making the above adjustments the Capital Accounts of B and C were to be adjusted on the basis of D Capital. Actual cash was to be brought in or to be paid off as the case may be.

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of the new firm.

'G', 'E' and 'F' were partners in a firm sharing profits in the ratio of 7:2:1. The Balance Sheet of the firm as on 31st March, 2011 was as follows:

Balance Sheet of 'G', 'E' and 'F'

as on 31st March, 2011

Liabilities

Amount

Rs

Assets

Amount

Rs

Capitals:

Goodwill

40,000

G

70,000

Land & Buildings

60,000

E

20,000

Machinery

40,000

F

10,000

1,00,000

Stock

7,000

General Reserve

20,000

Debtors

12,000

Loan from E

30,000

Cash

5,000

Creditors

14,000

1,64,000

1,64,000

E died on 24th August 2011. Partnership deed provides for the settlement of claims on the death of a partner of a partner in addition to his capital as under:

(i) The share of profit of deceased partner to be computed up to the date of death on the basis of average profits of the past three years which was Rs 80,000.

(ii) His share in profit/loss on revaluation of assets and re-assessment of liabilities which were as follows:

Land and Buildings were revalued at Rs 94,000, Machinery at Rs 38,000 and Stock at Rs 5,000. A provision of 2.5% was to be created on debtors for bad and doubtful debts.

(iii) The net amount payable to 'E's executors was transferred to his Loan Account, to be paid later on.

Prepare Revaluation Account, Partner's Capital Accounts, E's Executor A/c and Balance Sheet of 'G' and 'F' who decided to continue the business keeping their capital balances in their new profit sharing ratio. Any surplus or deficit to be transferred to current accounts of the partners.

Balance Sheet of 'G', 'E' and 'F'

as on 31st March, 2011

Liabilities

Amount

Rs

Assets

Amount

Rs

Capitals:

Goodwill

40,000

G

70,000

Land & Buildings

60,000

E

20,000

Machinery

40,000

F

10,000

1,00,000

Stock

7,000

General Reserve

20,000

Debtors

12,000

Loan from E

30,000

Cash

5,000

Creditors

14,000

1,64,000

1,64,000

(i) The share of profit of deceased partner to be computed up to the date of death on the basis of average profits of the past three years which was Rs 80,000.

(ii) His share in profit/loss on revaluation of assets and re-assessment of liabilities which were as follows:

Land and Buildings were revalued at Rs 94,000, Machinery at Rs 38,000 and Stock at Rs 5,000. A provision of 2.5% was to be created on debtors for bad and doubtful debts.

(iii) The net amount payable to 'E's executors was transferred to his Loan Account, to be paid later on.

Prepare Revaluation Account, Partner's Capital Accounts, E's Executor A/c and Balance Sheet of 'G' and 'F' who decided to continue the business keeping their capital balances in their new profit sharing ratio. Any surplus or deficit to be transferred to current accounts of the partners.

Distinguish between Fixed and Fluctuating Capital Accounts.

What is the maximum number of partners that a partnership firm can have? Name the Act that provides for the maximum number of partners in a partnership firm.

Nusrat and Sonu were partners in a firm sharing profits in the ratio of 3:2. During the year ended 31-3-2015 Nusrat had withdrawn Rs 15,000. Interest on her drawings amounted to Rs 300. Pass necessary journal entry for charging interest on drawing assuming that the capitals of the partners were fixed.

P and Q were partners in a firm sharing profits and losses equally. Their fixed capitals were ₹ 2,00,000 and ₹ 3,00,000 respectively. The partnership deed provided for interest on capital @ 12% per annum. For the year ended 31st March, 2016, the profits of the firm were distributed without providing interest on capital. Pass necessary adjustment entry to rectify the error.

Sponsor Area

Mock Test Series

Mock Test Series