Sponsor Area

Accounting For Partnership:Basic Concepts

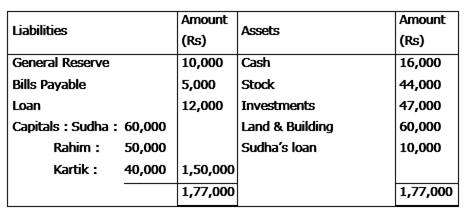

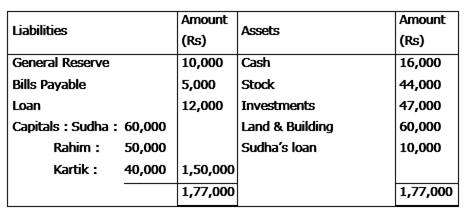

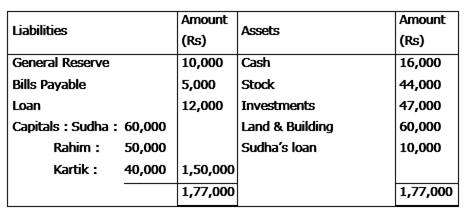

The Balance Sheet of Sudha, Rahim and Kartik who were sharing profit in the ratio of 3:3 4 as on 31st March, 2012 was as follows:

Sudha died on June 30th 2012. The partnership deed provided for the following on the death of a partner:

(a) Goodwill of the firm be valued at two years purchase of average profits for the last three years.

(b) Sudha’s share of profit or loss till the date of her death was to be calculated on the basis of sales. Sales for the year ended 31st March, 2012 amounted to Rs 4,00,000 and that from 1stApril to 30th June 2012 to Rs 1,50,000. The profit for the year ended 31st March, 2012 was Rs 1,00,000.

(c) Interest on capital was to be provided @ 6% p.a.

(d) The average profits of the last three years were Rs 42,000.

(e) According to Sudha’s will, the executors should donate her share to Matri Chhaya an orphanage for girls.

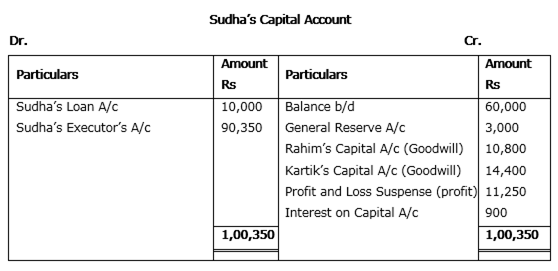

Prepare Sudha’s Capital Account to be rendered to her executor. Also identify the value being highlighted in the question.

Working Notes:

1) Calculation of Sudha’s Share of Goodwill

Goodwill of Firm = Average profits x 2 years purchase of average profit

= 42,000 x 2 = 84,000

Sudha’s share of goodwill = 84000 * 3/10 =25,200

2) Interest on sudha’s capital = 60000 * 6 /100 * 3/12 = 900

3) Calculation of Sudha’s Share of profits

If sales = 4,00,000

Profit = 1,00,000

If sales is 1, profit = 1,00,000 / 4,00,000

Profit = (1,00,000/4,00,000) * 1,50,000 = 37,500

Sudha’s Share = 37500 x 3/10 = 11,250

Values Involved in the given scenario:

(1) Sympathy, empathy and helping orphans.

(2) Fulfilment of social responsibility

Some More Questions From Accounting for Partnership:Basic Concepts Chapter

In the absence of partnership deed the profits of a firm are divided among the partners:

(a) In the ratio of capital

(b) Equally

(c) In the ratio of time devoted for the firm's business

(d) According to the managerial abilities of the partners

(a) In the ratio of capital

(b) Equally

(c) In the ratio of time devoted for the firm's business

(d) According to the managerial abilities of the partners

On 1-4-2013 Jay and Vijay, entered into partnership for supplying laboratory equipment’s to government schools situated in remote and backward areas. They contributed capitals of Rs 80,000 and Rs 50,000 respectively and agreed to share the profits in the ratio 3: 2. The partnership deed provided that interest on capital shall be allowed at 9% per annum. During the year the firm earned a profit of Rs 7,800.

Showing your calculations clearly, prepare 'Profit and Loss Appropriation Account' of Jay and Vijay for the year ended 31-3-2014.

Showing your calculations clearly, prepare 'Profit and Loss Appropriation Account' of Jay and Vijay for the year ended 31-3-2014.

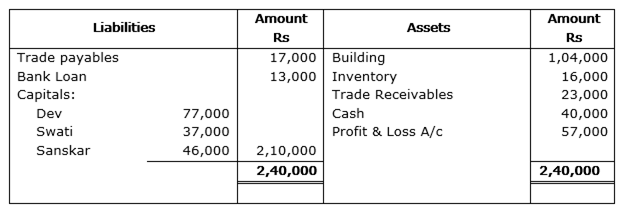

Dev, Swati and Sanskar were partners in a firm sharing profits in the ratio of 2:2:1. On 31-3-2014 their Balance Sheet was as follows:

On 30thJune, 2014 Dev died. According to partnership agreement Dev was entitled to interest on capital at 12% per annum. His share of profit till the date of his death was to be calculated on the basis of the average profits of last four years. The profit of the last four years were:

Years

Profit (RS)

2010-2011

2,04,000

2011-2012

1,80,000

2012-2013

90,000

2013-2014(Loss)

57,000

On 1-4-2014, Dev withdrew Rs 15,000 to pay for his medical bills.

Prepare Dev's account to be presented to his executors.

Satnam and Qureshi after doing their MBA decided to start a partnership firm to manufacture ISI marked electronic goods for economically weaker section of the society. Satnam also expressed his willingness to admit Juliee as partner without capital who is especially abled but a very creative and intelligent friend of him. Qureshi agreed to this. They formed a partnership on 1st April 2012 on the following terms:

(i) Satnam will contribute Rs 4,00,000 and Qureshi will contribute Rs 2,00,000 as capitals.

(ii) Satnam, Qureshi and Juliee will share profits in the ratio of 2:2:1.

(iii) Interest on capital will be allowed @ 6% p.a. Due to shortage of capital Satnam contributed Rs 50,000 on 30th September, 2012 and Qureshi contributed Rs 20,000 on 1st January, 2013 as additional capitals. The profit of the firm for the year ended 31st March, 2013 was Rs 3,37,800.

(a) Identify any two values which the firm wants to communicate to the society.

(b) Prepare Profit & Loss Appropriation Account for the year ending 31st March, 2013.

(ii) Satnam, Qureshi and Juliee will share profits in the ratio of 2:2:1.

(iii) Interest on capital will be allowed @ 6% p.a. Due to shortage of capital Satnam contributed Rs 50,000 on 30th September, 2012 and Qureshi contributed Rs 20,000 on 1st January, 2013 as additional capitals. The profit of the firm for the year ended 31st March, 2013 was Rs 3,37,800.

(a) Identify any two values which the firm wants to communicate to the society.

(b) Prepare Profit & Loss Appropriation Account for the year ending 31st March, 2013.

Naveen, Seerat and Hina were partners in a firm manufacturing blankets. They were sharing profits in the ratio of 5 : 3 : 2. Their capitals on 1st April, 2012 were Rs 2,00,000: Rs 3,00,000 and Rs 6,00,000 respectively. After the floods in Uttaranchal, all partners decided to help the flood victims personally. For this Naveen withdrew Rs 10,000 from the firm on 1st September, 2012. Seerat, instead of withdrawing cash from the firm took blankets amounting to Rs 12,000 from the firm and distributed to the flood victims. On the other hand, Hina withdrew Rs 2,00,000 from her capital on 1st January, 2013 and set up a centre to provide medical facilities in the flood affected area. The partnership deed provides for charging interest on drawings @ 6% p.a. After the Final Accounts were prepared, it was discovered that interest on drawings had not been charged. Give the necessary adjusting journal entry and show the working notes clearly. Also state any two values that the partners wanted to communicate to the society.

When the partner capitals are fixed, where the drawing made by a partner will be recorded?

Ali, Bimal and Deepak are partners in a firm. On 1st April, 2011 their capital accounts stood at Rs. 4,00,000, Rs. 3,00,000 and Rs. 2,00,000 respectively. They shared profits and losses in the proportion of 5:3:2. Partners are entitled to interest on capital @ 10% per annum and salary to Bimal and Deepak @ 2,000 per month and Rs. 3,000 per quarter respectively as per the provisions of the partnership deed.

Bimal's share of profit (excluding interest on capital but including salary) is guaranteed at a minimum of Rs. 50,000 p.a. Any deficiency arising on that account shall be met by Deepak. The profits of the firm for the year ended 31st March, 2012 amounted to Rs. 2,00,000. Prepare Profit & Loss Account for the year ended on 31st March, 2012.

Bimal's share of profit (excluding interest on capital but including salary) is guaranteed at a minimum of Rs. 50,000 p.a. Any deficiency arising on that account shall be met by Deepak. The profits of the firm for the year ended 31st March, 2012 amounted to Rs. 2,00,000. Prepare Profit & Loss Account for the year ended on 31st March, 2012.

The Balance Sheet of Sudha, Rahim and Kartik who were sharing profit in the ratio of 3:3 4 as on 31st March, 2012 was as follows:

Sudha died on June 30th 2012. The partnership deed provided for the following on the death of a partner:

(a) Goodwill of the firm be valued at two years purchase of average profits for the last three years.

(b) Sudha’s share of profit or loss till the date of her death was to be calculated on the basis of sales. Sales for the year ended 31st March, 2012 amounted to Rs 4,00,000 and that from 1stApril to 30th June 2012 to Rs 1,50,000. The profit for the year ended 31st March, 2012 was Rs 1,00,000.

(c) Interest on capital was to be provided @ 6% p.a.

(d) The average profits of the last three years were Rs 42,000.

(e) According to Sudha’s will, the executors should donate her share to Matri Chhaya an orphanage for girls.

Prepare Sudha’s Capital Account to be rendered to her executor. Also identify the value being highlighted in the question.

(b) Sudha’s share of profit or loss till the date of her death was to be calculated on the basis of sales. Sales for the year ended 31st March, 2012 amounted to Rs 4,00,000 and that from 1stApril to 30th June 2012 to Rs 1,50,000. The profit for the year ended 31st March, 2012 was Rs 1,00,000.

(c) Interest on capital was to be provided @ 6% p.a.

(d) The average profits of the last three years were Rs 42,000.

(e) According to Sudha’s will, the executors should donate her share to Matri Chhaya an orphanage for girls.

Prepare Sudha’s Capital Account to be rendered to her executor. Also identify the value being highlighted in the question.

State the provisions of Indian Partnership Act regarding the payment of remuneration to a partner for the services rendered.

Arun and Arora were partners in a firm sharing profits in the ratio of 5:3. Their fixed capitals on 1-4-2010 were: Arun Rs 60,000 and Arora Rs 80,000. They agreed to allow interest on capital @ 12% p.a. And to charge on drawings @ 15% p.a. The profit of the firm for the year ended 31-3 2011 before all above adjustments were Rs 12,600. The drawings made by Arun were Rs 2,000 and by Arora Rs 4,000 during the year. Prepare Profit and Loss Appropriation Account of Arun and Arora. Show your calculations clearly. The interest on capital will be allowed even if the firm incurs loss.

Sponsor Area

Mock Test Series

Mock Test Series