Sponsor Area

NCERT Solutions for Class 12 Accountancy Accountancy Part I Chapter 2 Accounting For Partnership:Basic Concepts

Accounting For Partnership:Basic Concepts Here is the CBSE Accountancy Chapter 2 for Class 12 students. Summary and detailed explanation of the lesson, including the definitions of difficult words. All of the exercises and questions and answers from the lesson's back end have been completed. NCERT Solutions for Class 12 Accountancy Accounting For Partnership:Basic Concepts Chapter 2 NCERT Solutions for Class 12 Accountancy Accounting For Partnership:Basic Concepts Chapter 2 The following is a summary in Hindi and English for the academic year 2025-26. You can save these solutions to your computer or use the Class 12 Accountancy.

In the absence of partnership deed the profits of a firm are divided among the partners:

(a) In the ratio of capital

(b) Equally

(c) In the ratio of time devoted for the firm's business

(d) According to the managerial abilities of the partners

(b) Equally: According to partnership act 1932, in the absence of any partnership deed, profits of the firm are divided among the partners equally.

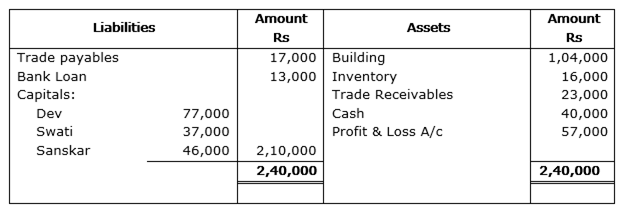

Dev, Swati and Sanskar were partners in a firm sharing profits in the ratio of 2:2:1. On 31-3-2014 their Balance Sheet was as follows:

On 30thJune, 2014 Dev died. According to partnership agreement Dev was entitled to interest on capital at 12% per annum. His share of profit till the date of his death was to be calculated on the basis of the average profits of last four years. The profit of the last four years were:

| Years | Profit (RS) |

| 2010-2011 | 2,04,000 |

| 2011-2012 | 1,80,000 |

| 2012-2013 | 90,000 |

| 2013-2014(Loss) | 57,000 |

On 1-4-2014, Dev withdrew Rs 15,000 to pay for his medical bills.

Prepare Dev's account to be presented to his executors.

Sponsor Area

Mock Test Series

Mock Test Series