Dissolution Of Partnership Firm

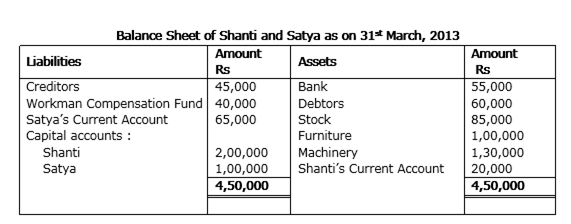

Shanti and Satya were partners in a firm sharing profits in the ratio of 4:1. On 31st March, 2013 their Balance Sheet was as follows:

On the above date the firm was dissolved:

(1) Shanti took over 40% of the stock at 10% less than its book value and the remaining stock was sold for Rs 40,000. Furniture realized Rs 80,000.

(2) An unrecorded investment was sold for Rs 20,000. Machinery was sold at a loss of Rs 60,000.

(3) Debtors realized Rs 55,000.

(4) There was an outstanding bill for repairs for which Rs 19,000 were paid. Prepare Realisation Account.

Calculation of value of stock took over by shanti:

(85000*40/100) * 90/100 = 30,600

Sponsor Area

Some More Questions From Dissolution Of Partnership Firm Chapter

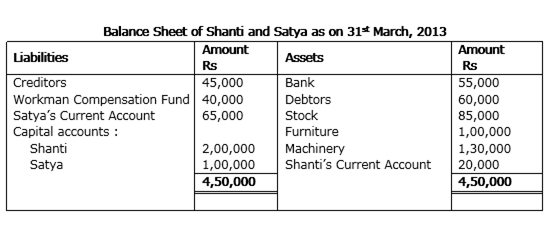

Shanti and Satya were partners in a firm sharing profits in the ratio of 4:1. On 31st March, 2013 their Balance Sheet was as follows:

On the above date the firm was dissolved:

(1) Shanti took over 40% of the stock at 10% less than its book value and the remaining stock was sold for Rs 40,000. Furniture realized Rs 80,000.

(2) An unrecorded investment was sold for Rs 20,000. Machinery was sold at a loss of Rs 60,000.

(3) Debtors realized Rs 55,000.

(4) There was an outstanding bill for repairs for which Rs 19,000 were paid. Prepare Realisation Account.

Shanti and Satya were partners in a firm sharing profits in the ratio of 4:1. On 31st March, 2013 their Balance Sheet was as follows:

On the above date the firm was dissolved:

(1) Shanti took over 40% of the stock at 10% less than its book value and the remaining stock was sold for Rs 40,000. Furniture realized Rs 80,000.

(2) An unrecorded investment was sold for Rs 20,000. Machinery was sold at a loss of Rs 60,000.

(3) Debtors realized Rs 55,000.

(4) There was an outstanding bill for repairs for which Rs 19,000 were paid. Prepare Realisation Account.

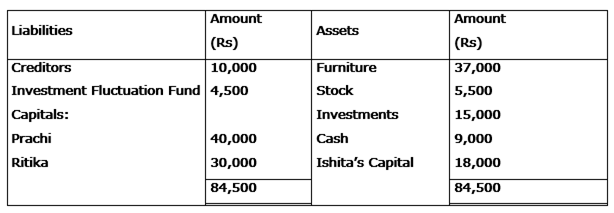

Prachi, Ritika and Ishita were partners in a firm sharing profits and losses in the ratio of 5:3:2. In spite of repeated reminders by the authorities, they kept dumping hazardous material into a nearby river. The court ordered for the dissolution of their partnership firm on 31st March 2012. Prachi was deputed to realise the assets and pay the liabilities. She was paid Rs 1,000 as commission for her services. The financial position of the firm was as follows:

Following was agreed upon:

Prachi took over investments for Rs 12,500. Stock and furniture realized Rs 41,500. There was old furniture which has been written off completely from the books. Ritika agreed to take away the same at the price of Rs 3,000. Compensation paid to the employees amounted to Rs 8,000. This liability was not provided in the above Balance Sheet. Realization expenses amounted to Rs 1,000. Prepare Realisation Account, Partner’s Capital Accounts and Cash A/c to close the books of the firm.

Also identify the value being conveyed in the question.

Pass the necessary Journal entries for the following transactions on the dissolution of the firm of P and Q after the various assets (other than cash) and outside liabilities have been transferred to Realisation Account.

(i) Bank Loan Rs. 12,000 was paid.

(ii) Stock worth Rs. 16,000 was taken over by partner Q.

(iii) Partner P paid a creditor Rs. 4,000.

(iv) An asset not appearing in the books of accounts realised Rs. 1,200.

(v) Expenses of realisation Rs. 2,000 were paid by partner Q.

(vi) Profit on realisation Rs. 36,000 was distributed between P and Q in 5:4 ratio.

Distinguish between 'Dissolution of Partnership' and 'Dissolution of Partnership Firm on the basis of 'Economic Relationship'.

L and M were partners in a firm sharing profits in the ratio of 2:3. On 28-2-2016 the firm was dissolved. After transferring assets (other than cash) and outsiders' liabilities to realization account you are given the following information:

(a) A creditor for ₹ 1,40,000 accepted building valued at ₹ 1,80,000 and paid to the firm ₹ 40,000.

(b) A second creditor for ₹30,000 accepted machinery valued at ₹28,000 in full settlement of his claim.

(c) A third creditor amounting to ₹70,000 accepted ₹30,000 in cash and investments of the book value of ₹45,000 in full settlement of his claim.

(d) Loss on dissolution was ₹4,000.

Pass necessary journal entries for the above transactions in the books of the firm assuming that all payments were made by cheque.

Pass necessary journal entries on the dissolution of a partnership firm in the following cases:

(i) Expenses of dissolution were ₹ 9,000.

(ii) Expenses of dissolution ₹ 3,400 were paid by a partner, Vishal.

(iii) Shiv, a partner, agreed to do the work for dissolution for a commission of ₹ 4,500. He also agreed to bear the dissolution expenses. Actual dissolution expenses ₹ 3,900 were paid from the firm's bank account.

(iv) Naveen, a partner, agreed to look after the dissolution work for which he was allowed a remuneration of ₹ 3,000. Naveen also agreed to bear the dissolution expenses. Actual expenses on dissolution ₹ 2,700 were paid by Naveen.

(v) Vivek, a partner, was appointed to look after the dissolution work for a remuneration of ₹ 7,000. He agreed to bear the dissolution expenses. Actual dissolution expenses ₹ 6,500 were paid by Rishi, another partner, on behalf of Vivek.

(vi) Gaurav, a partner, was appointed to look after the work of dissolution for a commission of ₹ 12,500. He agreed to bear the dissolution expenses. Gaurav took over furniture of ₹ 12,500 as his commission. The furniture had already been transferred to realisation account.

Mock Test Series

Sponsor Area

NCERT Book Store

NCERT Sample Papers

Sponsor Area