Sponsor Area

Dissolution Of Partnership Firm

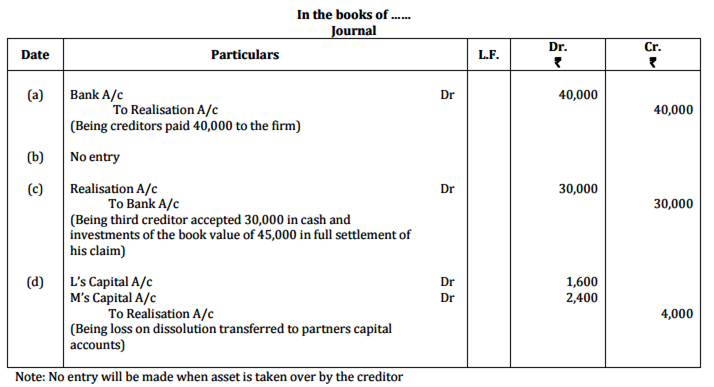

L and M were partners in a firm sharing profits in the ratio of 2:3. On 28-2-2016 the firm was dissolved. After transferring assets (other than cash) and outsiders' liabilities to realization account you are given the following information:

(a) A creditor for ₹ 1,40,000 accepted building valued at ₹ 1,80,000 and paid to the firm ₹ 40,000.

(b) A second creditor for ₹30,000 accepted machinery valued at ₹28,000 in full settlement of his claim.

(c) A third creditor amounting to ₹70,000 accepted ₹30,000 in cash and investments of the book value of ₹45,000 in full settlement of his claim.

(d) Loss on dissolution was ₹4,000.

Pass necessary journal entries for the above transactions in the books of the firm assuming that all payments were made by cheque.

Some More Questions From Dissolution Of Partnership Firm Chapter

Sponsor Area

Mock Test Series

Mock Test Series