Sponsor Area

Reconstitution Of A Partnership Firm - Retirement Or Death Of A Partner

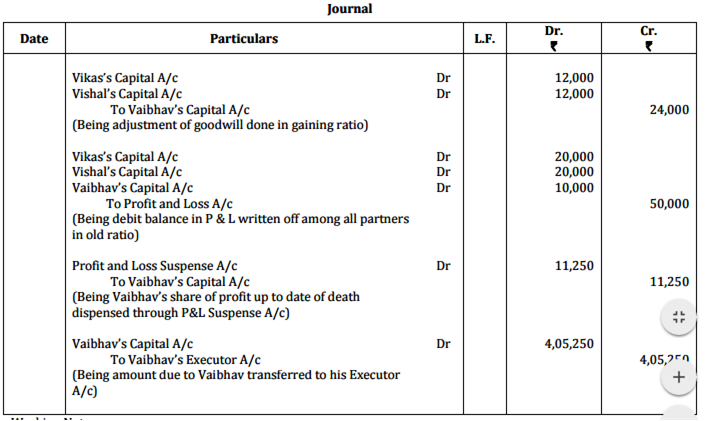

Vikas, Vishal and Vaibhav were partners in a firm sharing profits in the ratio of 2:2:1. The firm closes its books 31st March every year. On 31-12-2015 Vaibhav died. On that date his Capital account showed a credit balance of ₹ 3,80,000 and Goodwill of the firm was valued at ₹ 1,20,000. There was a debit balance of ₹ 50,000 in the profit and loss account. Vaibhav's share of profit in the year of his death was to be calculated on the basis of the average profit of last five years. The average profit of last five years was ₹ 75,000. Pass necessary journal entries in the books of the firm on Vaibhav's death.

Working Notes:

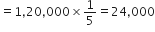

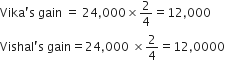

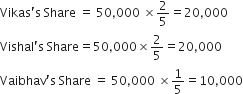

WN(1): Calculation of Vaibhav’s Share of Goodwill

24,000 will be borne by gaining partners in gaining ratio.

Since, nothing is specified; it is assumed that continuing partners gain in their old profit sharing ratio of 2:2

WN2: Calculation of Share of Debit balance in P&L A/c

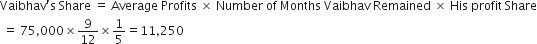

WN3: Calculation of Share in Profit (earned during the year)

WN 4: Calculation of Amount transferred to Vaibhav's Executor A/c

Amount due to Vaibhav = Capital + Credit Items - Debit Items

=3,80,000 + 24,000 - 10,000 + 11,250=4,05,250

Some More Questions From Reconstitution of a Partnership Firm - Retirement or Death of a Partner Chapter

M, N and O were partners in a firm sharing profits and losses equally. Their Balance Sheet on 31-12-2009 was as follows:

Liabilities

Amount(Rs)

Assets

Amount(Rs)

Capital: M 70,000

N 70,000

O 70,000

General Reserve

Creditors

2,10,000

30,000

20,000

Plant and Machinery

Stock

Sundry Debtors

Cash at Bank

Cash in Hand

60,000

30,000

95,000

40,000

35,000

2,60,000

2,60,000

N died on 14th March, 2010. According to the Partnership Deed, executors of the deceased partner are entitled to:

(i) Balance of partner's capital account.

(ii) Interest on Capital @ 5% p.a.

(iii) Share of goodwill calculated on the basis of twice the average of past three year's profits and

(iv) Share of profits from the closure of the last accounting year till the date of death on the basis of twice the average of three completed year's profits before death.

Profits for 2007, 2008 and 2009 were Rs. 80,000, Rs. 90,000, Rs. 1,00,000 respectively. Show the working for deceased partner's share of goodwill and profits till the date of his death. Pass the necessary journal entries and prepare N's Capital Account to be rendered to his executors.

Liabilities

Amount(Rs)

Assets

Amount(Rs)

Capital: M 70,000

N 70,000

O 70,000

General Reserve

Creditors

2,10,000

30,000

20,000

Plant and Machinery

Stock

Sundry Debtors

Cash at Bank

Cash in Hand

60,000

30,000

95,000

40,000

35,000

2,60,000

2,60,000

(ii) Interest on Capital @ 5% p.a.

(iii) Share of goodwill calculated on the basis of twice the average of past three year's profits and

(iv) Share of profits from the closure of the last accounting year till the date of death on the basis of twice the average of three completed year's profits before death.

Profits for 2007, 2008 and 2009 were Rs. 80,000, Rs. 90,000, Rs. 1,00,000 respectively. Show the working for deceased partner's share of goodwill and profits till the date of his death. Pass the necessary journal entries and prepare N's Capital Account to be rendered to his executors.

Ashok, Babu and Chetan were partners in a firm sharing profits in the ratio of 4:3:3. The firm closes its books on 31st March every year. On 31st December, 2016 Ashok died. The partnership deed provided that on the death of a partner his executors will be entitled for the following:

(i) Balance in his capital account. On 1.4.2016, there was a balance of ₹ 90,000 in Ashok’s Capital Account.

(ii) Interest on Capital @12% per annum

(iii) His share in the profits of the firm in the year of his death will be calculated on the basis of rate of net profit on sales of the previous year, which was 25%. The sales of the firm till 31st December, 2016 were ₹ 4,00,000.

(iv) His share in the goodwill of the firm. The goodwill of the firm on Ashok’s death was valued at 4,50,000.

The partnership deed also provided for the following deduction from the amount payable to the executor of the decreased partner:

(i) His drawings in the year of his death, Ashok’s drawings till 31.12.2016 were ₹ 15,000.

(ii) Interest on drawings @12 % per annum which was calculated on ₹ 1,500.

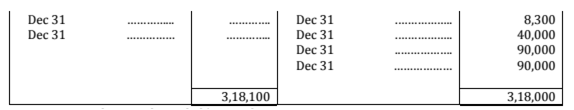

The accountant of the firm prepared Ashok's Capital Account as prepared by the firm accountant is given below

You are required to complete Ashoka's Capital Account.

(i) Balance in his capital account. On 1.4.2016, there was a balance of ₹ 90,000 in Ashok’s Capital Account.

(ii) Interest on Capital @12% per annum

(iii) His share in the profits of the firm in the year of his death will be calculated on the basis of rate of net profit on sales of the previous year, which was 25%. The sales of the firm till 31st December, 2016 were ₹ 4,00,000.

(iv) His share in the goodwill of the firm. The goodwill of the firm on Ashok’s death was valued at 4,50,000.

The partnership deed also provided for the following deduction from the amount payable to the executor of the decreased partner:

(i) His drawings in the year of his death, Ashok’s drawings till 31.12.2016 were ₹ 15,000.

(ii) Interest on drawings @12 % per annum which was calculated on ₹ 1,500.

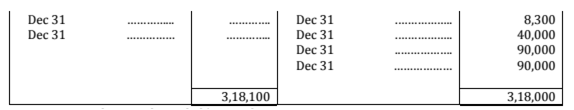

The accountant of the firm prepared Ashok's Capital Account as prepared by the firm accountant is given below

You are required to complete Ashoka's Capital Account.

Sponsor Area

Mock Test Series

Mock Test Series