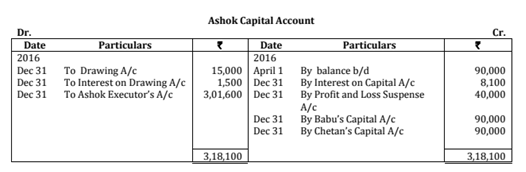

Ashok, Babu and Chetan were partners in a firm sharing profits in the ratio of 4:3:3. The firm closes its books on 31st March every year. On 31st December, 2016 Ashok died. The partnership deed provided that on the death of a partner his executors will be entitled for the following:

(i) Balance in his capital account. On 1.4.2016, there was a balance of ₹ 90,000 in Ashok’s Capital Account.

(ii) Interest on Capital @12% per annum

(iii) His share in the profits of the firm in the year of his death will be calculated on the basis of rate of net profit on sales of the previous year, which was 25%. The sales of the firm till 31st December, 2016 were ₹ 4,00,000.

(iv) His share in the goodwill of the firm. The goodwill of the firm on Ashok’s death was valued at 4,50,000.

The partnership deed also provided for the following deduction from the amount payable to the executor of the decreased partner:

(i) His drawings in the year of his death, Ashok’s drawings till 31.12.2016 were ₹ 15,000.

(ii) Interest on drawings @12 % per annum which was calculated on ₹ 1,500.

The accountant of the firm prepared Ashok's Capital Account as prepared by the firm accountant is given below

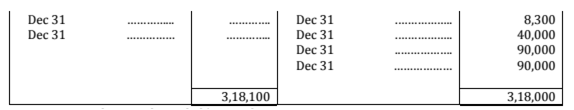

You are required to complete Ashoka's Capital Account.