Sponsor Area

Issue And Redemption Of Debentures

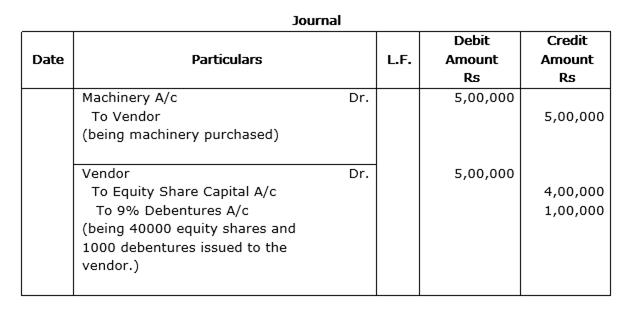

'Sangam Woollens Ltd.', Ludhiana, are the manufacturers and exporters of woollen garments. The company decided to distribute free of cost woollen garments to 10 villages of Lahaul and Spiti District of Himachal Pradesh. The company also decided to employ 50 young persons from these village in its newly established factory. The company issued 40,000 equity shares of Rs 10 each and 1,000 9% debentures of Rs 100 each to the vendors for the purchase of machinery of Rs 5,00,000.

Pass necessary Journal Entries. Also identify any one value that the company wants to communicate to the society.

Values involved in the above scenario:

(i) Creation of employment opportunities in rural areas.

(ii) An attempt for balanced regional development.

Some More Questions From Issue and Redemption of Debentures Chapter

'Sangam Woollens Ltd.', Ludhiana, are the manufacturers and exporters of woollen garments. The company decided to distribute free of cost woollen garments to 10 villages of Lahaul and Spiti District of Himachal Pradesh. The company also decided to employ 50 young persons from these village in its newly established factory. The company issued 40,000 equity shares of Rs 10 each and 1,000 9% debentures of Rs 100 each to the vendors for the purchase of machinery of Rs 5,00,000.

Pass necessary Journal Entries. Also identify any one value that the company wants to communicate to the society.

Pass necessary Journal Entries. Also identify any one value that the company wants to communicate to the society.

Bharat Ltd. had an authorized capital of Rs 20,00,000 divided into 2,00,000 equity shares of Rs 10 each. The company issued 1,00,000 shares and the dividend paid per share was Rs 2 for the year ended 31-3-2008. The management of the company decided to export its products to the neighbouring countries Nepal, Bhutan, Sri Lanka and Bangladesh. To meet the requirement of additional funds the financial manager of the company put up the following three alternatives before its Board of Directors:

(i) Issue 54,000 equity shares

(ii) Obtain a loan from Import and Export Bank of India. The loan was available at 12% per annum interest.

(iii) To issue 9% Debentures at a discount of 10%.

After comparing the available alternatives the company decided on 1-4-2008 to issue 6,000 9% debentures of Rs 100 each at a discount of 10%. These debentures were redeemable in four installments starting from the end of third year. The amount of debentures to be redeemed at the end of third, fourth, fifth and sixth year was as follows:

Year

Profit Rs

III

1,00,000

IV

1,00,000

V

2,00,000

VI

2,00,000

Prepare 9% Debentures Account for the year 2008-09 to 2013-14.

(ii) Obtain a loan from Import and Export Bank of India. The loan was available at 12% per annum interest.

(iii) To issue 9% Debentures at a discount of 10%.

After comparing the available alternatives the company decided on 1-4-2008 to issue 6,000 9% debentures of Rs 100 each at a discount of 10%. These debentures were redeemable in four installments starting from the end of third year. The amount of debentures to be redeemed at the end of third, fourth, fifth and sixth year was as follows:

Give the meaning of 'Debenture'.

BG. Ltd. issued 2,000, 12% debentures of Rs 100 each on 1st April 2012. The issue was fully subscribed. According to the terms of issue, interest on the debentures is payable half-yearly on 30th September and 31st March and the tax deducted at source is 10%. Pass necessary journal entries related to the debenture interest for the half-yearly ending 31st March 2013 and transfer of interest on debentures of the year to the Statement of Profit & Loss.

Pass necessary journal entries in the following cases:

(i) Z Ltd redeemed 1500, 12% debentures of Rs 100 each issued at a discount of 6% by converting them into equity shares of Rs 100 each issued at a premium of Rs 25 per share.

(ii) X Ltd. converted 1,000, 12% debentures of Rs 100 each issued at a discount of Rs 10 per debenture into equity shares of Rs 100 each Rs 90 paid up.

(i) Z Ltd redeemed 1500, 12% debentures of Rs 100 each issued at a discount of 6% by converting them into equity shares of Rs 100 each issued at a premium of Rs 25 per share.

(ii) X Ltd. converted 1,000, 12% debentures of Rs 100 each issued at a discount of Rs 10 per debenture into equity shares of Rs 100 each Rs 90 paid up.

What is meant by issue of debentures as a collateral security?

Pass the necessary journal entries for issue of 1,000, 7% Debentures of Rs. 100 each in the following cases:

(a) Issued at 5% premium redeemable at a premium of 10%.

(b) Issued at a discount of 5% redeemable at par.

(a) Issued at 5% premium redeemable at a premium of 10%.

(b) Issued at a discount of 5% redeemable at par.

Taneja Constructions Ltd. has an outstanding balance of Rs. 5,00,000, 7% debentures of Rs. 100 each redeemable at a premium of 10%. According to the terms of redemption, the company redeemed 30% of the above debentures by converting them into shares of Rs. 50 each at a premium of 20%. Record the entries for redemption of debentures in the books of Taneja Constructions Ltd.

Give any one advantage for the redemption of debentures by purchase in the open market?

Narain Laxmi Ltd. invited applications for issuing 7500, 12% Debentures of Rs100 each at a premium of Rs 35 per Debenture. The full amount was payable on application.

Applications were received for 10,000 Debentures. Applications for 2500 Debentures were rejected and the application money was refunded. Debentures were allotted to the remaining applicants.

Pass necessary Journal Entries for the above transactions in the books of Narain Laxmi Ltd.

Applications were received for 10,000 Debentures. Applications for 2500 Debentures were rejected and the application money was refunded. Debentures were allotted to the remaining applicants.

Pass necessary Journal Entries for the above transactions in the books of Narain Laxmi Ltd.

Sponsor Area

Mock Test Series

Mock Test Series