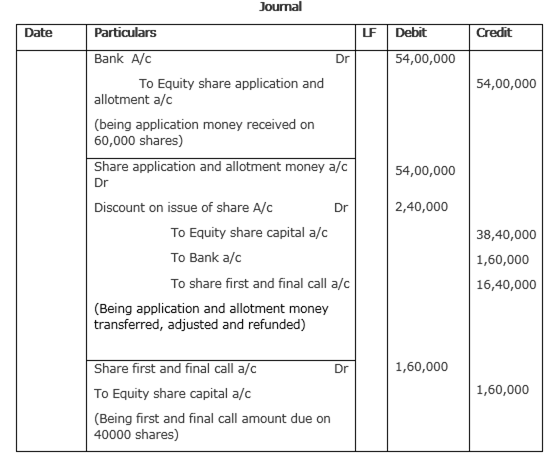

XYZ Ltd. invited applications for 40,000 equity shares of Rs 100 each at a discount of 6%. The amount was payable as follows:

On Application and Allotment Rs 90 per share. On First and Final call the balance amount. Application for 60,000 shares were received. Applications for 10,000 shares were rejected and shares were allotted on pro-rata basis to remaining applicants. Excess application money received on application and allotment was adjusted towards sums due on first and final call. The calls were made. A shareholder, who applied for 50 share, failed to pay the first and final call money. His shares were forfeited. All the forfeited shares were re-issued at Rs 97 per share fully paid up.

Pass necessary journal entries for the above transactions in the books of XYZ Ltd.

Important Note: As the shareholder has already paid excess amount than required on first and final call as he has applied for, this answer cannot proceed further.

Calculation of excess amount received

Amount received = 50*90=4500

Less amount to be received = 40*90=3600

Excess amount received= 900 Rs

Amount due on first and final call = 40*4 = Rs 160.

As he has already paid amount of Rs 900 in excess at the time of application and allotment, forfeiture is not possible in this case.

Thus, this question has incomplete or wrong information, hence, cannot be solved fully.

Calculation of total amount to be refunded.

Amount paid by 50,000 shares = 45, 00, 000

Less amount to be paid = 36, 00, 000

Excess application money received = 9,00,000

Less amount due on first and final call = 1, 60,000

Amount refunded through bank = 7,40,000

Add amount to be refunded = 9,00,000

Total =16,40,000