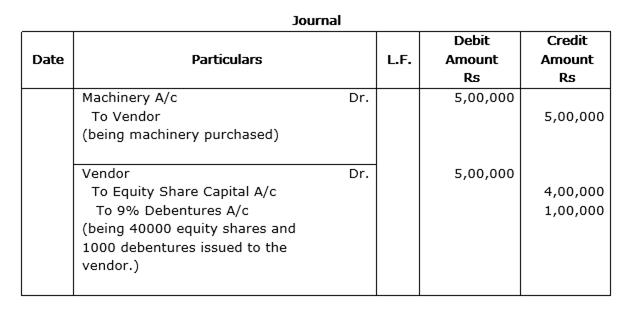

'Sangam Woollens Ltd.', Ludhiana, are the manufacturers and exporters of woollen garments. The company decided to distribute free of cost woollen garments to 10 villages of Lahaul and Spiti District of Himachal Pradesh. The company also decided to employ 50 young persons from these village in its newly established factory. The company issued 40,000 equity shares of Rs 10 each and 1,000 9% debentures of Rs 100 each to the vendors for the purchase of machinery of Rs 5,00,000.

Pass necessary Journal Entries. Also identify any one value that the company wants to communicate to the society.

Values involved in the above scenario:

(i) Creation of employment opportunities in rural areas.

(ii) An attempt for balanced regional development.