Money and Credit

Read the diagram given below and answer the questions that follow:

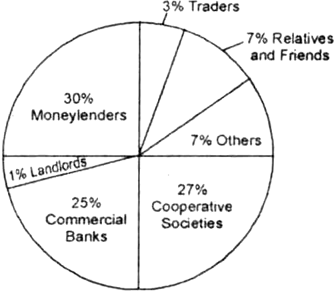

Sources of Credit for Rural households in India in 2003

(i)Which are the two major sources of credit for rural households in India?

(ii) Which one of them is the most dominant source of credit for rural households?

(iii) Why is it the most dominant source of credit?

(i) Moneylenders and cooperative societies.

(ii) Moneylenders.

(iii) It is because, small farmers are poor, semi-literate or illiterate and cannot fulfil the conditions of collaterals.

Sponsor Area

Some More Questions From Money and Credit Chapter

_________ costs of borrowing increase the debt-burden.

_________ issues currency notes on behalf of the Central Government.

Banks charge a higher interest rate on loans than what they offer on ________.

_________ is an asset that the borrower owns and uses as a guarantee until the loan is repaid to the lender.

In a SHG most of the decisions regarding savings and loan activities are taken by:

Formal sources of credit does not include:

Why do we need to expand formal sources of credit in India?

Why is money accepted as a medium of exchange in India?

Answer the questions asked below:

(i)Why are transactions are made in money?

(ii)Why is money is called a medium of exchange?

(iii)What is the most significant feature of the barter system?

Explain the functions of money.

Mock Test Series

Sponsor Area

NCERT Book Store

NCERT Sample Papers

Sponsor Area