Sponsor Area

The Government : Budget And The Economy

Question

What do you understand by Budget Receipts (Govt. Receipts)? Describe its two types.

Solution

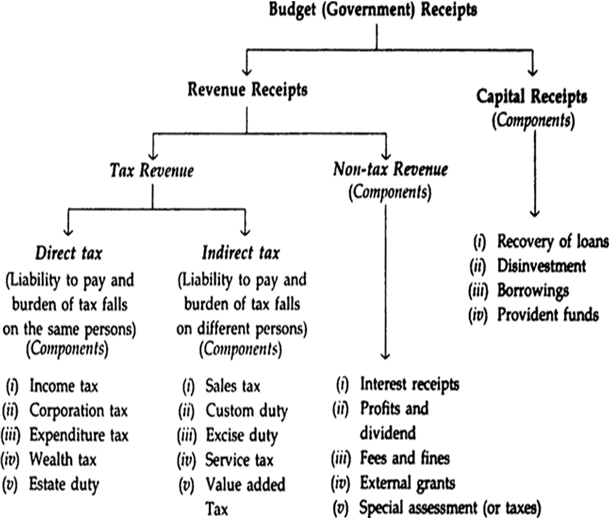

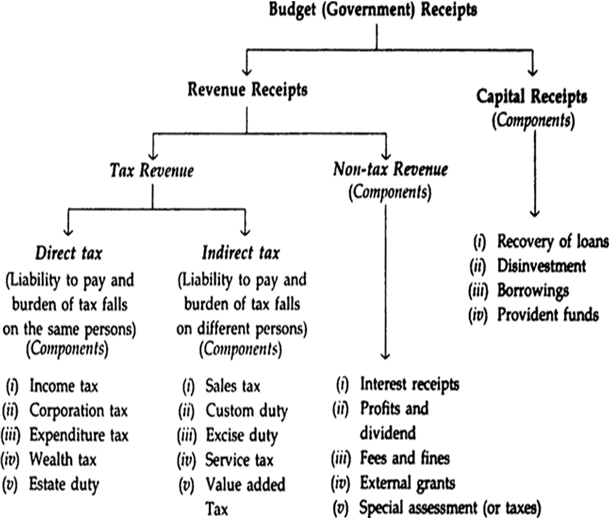

Meaning. Budget receipts refer to estimated money receipts of the government from all the sources during a fiscal year. It shows the sources from where the government intends to get money to finance the expenditure (both revenue and capital expenditure). Budget receipts are of two types — Revenue Receipts and Capital Receipts — as explained below. Their components are shown in the following chart.

Note: According to Government Budget for 2010-11, Receipt of 1 Rupee conies from: Income tax 9 paise, corporation tax 23 paise, custom duty 9 paise, excise duty 10 paise, services and other taxes 6 paise, Non-taxes Revenue 11 paise, borrowing and other liability 29 paise, non-debt Capital receipts 3 paisa = 100 paise.

Note: According to Government Budget for 2010-11, Receipt of 1 Rupee conies from: Income tax 9 paise, corporation tax 23 paise, custom duty 9 paise, excise duty 10 paise, services and other taxes 6 paise, Non-taxes Revenue 11 paise, borrowing and other liability 29 paise, non-debt Capital receipts 3 paisa = 100 paise.

Some More Questions From The Government : Budget And The Economy Chapter

Describe components of Revenue Receipts (Receipts from tax revenue and non tax revenue).

or

Distinguish between Tax and non-tax revenue. Name two sources of non-tax revenue receipts.

Explain components of Capital Receipts.

or

Name two sources of Capital Receipts.

or

Why is recovery of loan treated as a capital receipt?

Giving reasons categorise the following into revenue receipts and capital receipts.

(i) Recovery of loans, (ii) Corporation tax, (iii) Dividend on investment made by govt. (iv) Sale of public sector undertaking.

Define a tax.

Distinguish between Direct and Indirect taxes.

or

What is the basis of classifying taxes into direct tax and indirect tax? Give an example of each.

Classify the following into direct and indirect tax. Give reasons.

(i) Wealth tax, (ii) Entertainment tax, and (iii) Income tax.

What is meant by Budget (Government) Expenditure? Describe its components (items).

Distinguish between revenue expenditure and capital expenditure.

or

What is the basis of classifying government expenditure into revenue expenditure and capital expenditure?

Why are subsidies treated as revenue expenditure?

Why is payment of interest a revenue expenditure?

Sponsor Area

Mock Test Series

Mock Test Series