Sponsor Area

The Government : Budget And The Economy

Explain the two components (revenue budget and capital budget) of government budget.

Components of the budget. The budget is divided into two parts — (i) Revenue Budget, and (ii) Capital Budget.

(i) The Revenue Budget comprises current revenue receipts and current expenditure met from such revenues. The revenue receipts include both tax revenue (like income tax, excise duty) and non-tax revenue (like interest receipts, profits). (ii) Capital Budget consists of capital receipts (like borrowing, disinvestment) and capital expenditure (creation of assests, investment) of the government. Capital receipts are receipts of the government which create liabilities or reduce assets. Capital expenditure is the expenditure of the government which either reduces liability or creates an asset. Thus, capital budget is an account of assets and liabilities of the government which takes into consideration changes in capital.

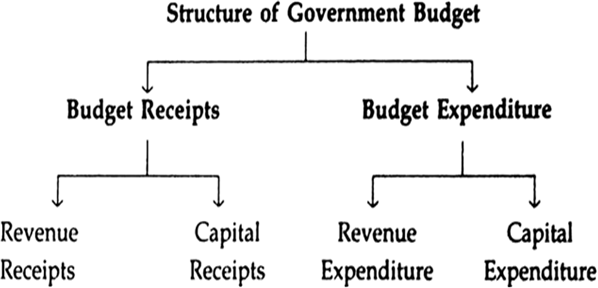

The structure (or components) of a government budget broadly consists of two parts — Budget Receipts and Budget Expenditure as shown in the following chart. Let us see their classification.

Some More Questions From The Government : Budget And The Economy Chapter

Differentiate between Revenue Receipts and Capital Receipts.

Describe components of Revenue Receipts (Receipts from tax revenue and non tax revenue).

or

Distinguish between Tax and non-tax revenue. Name two sources of non-tax revenue receipts.

Explain components of Capital Receipts.

or

Name two sources of Capital Receipts.

or

Why is recovery of loan treated as a capital receipt?

Giving reasons categorise the following into revenue receipts and capital receipts.

(i) Recovery of loans, (ii) Corporation tax, (iii) Dividend on investment made by govt. (iv) Sale of public sector undertaking.

Define a tax.

Distinguish between Direct and Indirect taxes.

or

What is the basis of classifying taxes into direct tax and indirect tax? Give an example of each.

Classify the following into direct and indirect tax. Give reasons.

(i) Wealth tax, (ii) Entertainment tax, and (iii) Income tax.

What is meant by Budget (Government) Expenditure? Describe its components (items).

Distinguish between revenue expenditure and capital expenditure.

or

What is the basis of classifying government expenditure into revenue expenditure and capital expenditure?

Why are subsidies treated as revenue expenditure?

Sponsor Area

Mock Test Series

Mock Test Series