Sponsor Area

Financial Statements Of A Company

Financial Statements are prepared following the constituent accounting concepts principles procedures and also the legal environment in which the business organisationoperate. These statements are the source of information on the basis of which conclusions are drawn about the profitability and financial position of a

company so that their users can easily understand and use them in their economic decisions in a meaningful way.

From the above statements identify any two values that a company should observe while preparing its financial statements. Also, State under which major headings and sub-headings the following items will be presented in the Balance Sheet of a company as per Schedule III of the Companies Act 2013.

(i) Capital Reserve

(ii) Calls-in-Advance

(iii) Loose Tools

(iv) Bank Overdraft

The values that must be observed by a company while preparing its financial statements are

(a) these statements must be drawn following the defined accounting concepts, principles and methods, and

(b) the financial statements should be drawn following the legal framework of the country of operations.

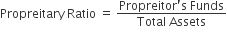

Proprietary Ratio of M Ltd. 0.80 : 1

| Transactions | Effects |

| (a) Obtained a loan from bank Rs 2,00,000 Payable after 5 years | Decrease, The total assets would increase with the amount of loan raised and proprietor's fund remains the same |

| (b) Purchased machinery for cash Rs 75,000 | No Change, Total Assets will increase and decrease by same amount |

| (c) Redeemed 5% Redeemable preference shares Rs 1,00,000 | Decrease, Proprietor's Funds and Total Assets both will decrease by same amount but the percentage change would be more in Proprietor's Fund already in ratio 0.80 : 1 |

| (d) Issued equity shares to vendors of machinery purchased of Rs. 4,00,000 | Increase, Even though both Proprietor’s Funds and Total Assets both will increase by same amount but the percentage change would be more in Proprietor's Fund |

Some More Questions From Financial Statements Of A Company Chapter

One of the objectives of ‘Financial Statements Analysis’ is to identify the reasons for the change in the financial position of the enterprise, State two more objectives of this analysis.

Name any two items that are shown under the head’ Other Current Liabilities’ and any two items that are shown under the head ‘Other Current Assets’ in the Balance Sheet of a company as per schedule III of the Companies Act, 2013

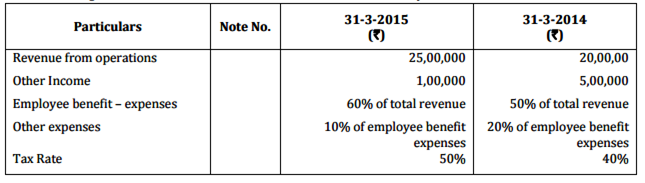

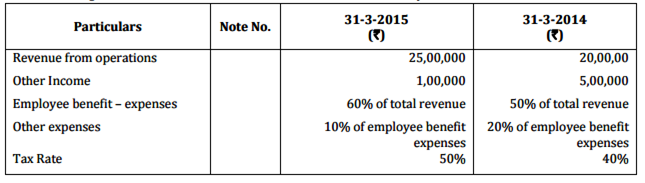

Following is the statement of Profit and Loss of Sun India Ltd. For the year ended 31st March. 2015:

The motto of Sun India Ltd is to produce and supply green energy in the rural areas of India. It has also taken up a project of constructing a road that will pass through five villages so that these villages could be connected to the nearby town. It will use the local resources and employ local people for construction of the road. You are required to prepare a Comparative Statement of Profit and Loss of Sun India Ltd from the given statement of Profit and Loss. Also, identify any two values that the company wishes to convey to the society

The motto of Sun India Ltd is to produce and supply green energy in the rural areas of India. It has also taken up a project of constructing a road that will pass through five villages so that these villages could be connected to the nearby town. It will use the local resources and employ local people for construction of the road. You are required to prepare a Comparative Statement of Profit and Loss of Sun India Ltd from the given statement of Profit and Loss. Also, identify any two values that the company wishes to convey to the society

Sponsor Area

Mock Test Series

Mock Test Series