Sponsor Area

Accounting Ratios

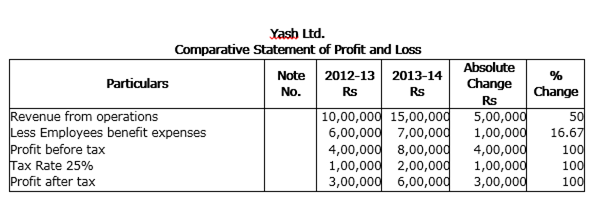

The motto of Yash Ltd., an advertising company is 'Service with Dignity'. Its management and work force is hard-working, honest and motivated. The net profit of the company doubled during the year ended 31-3-2014. Encouraged by its performance company decided to give one-month extra salary to all its employees. Following is the Comparative Statement of Profit and Loss of the company for the years ended 31st March 2013 and 2014.

(a) Calculate Net Profit Ratio for the years ending 31st March, 2013 and 2014.

(b) Identify any two values which Yash Ltd. is trying to propagate.

31/ March/ 2013:

Net Profit Ratio = ( Net profit after tax/ revenue from operations)*100

= (3,00,000/10,00,000)*100 = 30%

31/ March/2014:

Net Profit Ratio = (Net Profit after tax/ Revenue from operations)*100

= (6,00,000/ 15,00,000)* 100 = 40%

Values of Yash Ltd:

(i) Focus on consideration and welfare of employees.

(ii) Motivating and boosting the morale of employees form better performance.

Some More Questions From Accounting Ratios Chapter

Compute Working Capital Turnover Ratio using the following information:

Particulars

Amount (Rs)

Cash Sales

1,30,000

Credit Sales

3,80,000

Sales Returns

10,000

Liquid Assets

1,40,000

Current Liabilities

1,05,000

Inventory

90,000

Compute Debt Equity Ratio using the following information:

Particulars

Amount (RS.)

Total Assets

3,50,000

Total Debts

2,50,000

Current Liabilities

80,000

O.M. Ltd has a Current Ratio of 3.5:1 and Quick Ratio of 2:1. If the excess of Current Assets over Quick Assets as represented by Stock is Rs 1,50,000, calculate Current Assets and Current Liabilities.

From the following information, calculate any two of the following ratios:

(a) Debt-Equity Ratio

(b) Working Capital Turnover Ration and

(c) Return on Investment

Information: Equity Share capital Rs 50,000, General Reserve Rs 5,000; Profit and Loss

Account after tax and interest Rs 15,000; 9% Debenture Rs 20,000; Creditors Rs 15,000; Land and Building Rs 65,000; Equipment Rs 15,000; Debtors Rs 14,500 and Cash Rs 5,500. Discount on issue of shares Rs 5,000

Sales for the year ended 31-3-2011 was Rs 1,50,000. Tax rate 50%.

(a) Debt-Equity Ratio

(b) Working Capital Turnover Ration and

(c) Return on Investment

Information: Equity Share capital Rs 50,000, General Reserve Rs 5,000; Profit and Loss

Account after tax and interest Rs 15,000; 9% Debenture Rs 20,000; Creditors Rs 15,000; Land and Building Rs 65,000; Equipment Rs 15,000; Debtors Rs 14,500 and Cash Rs 5,500. Discount on issue of shares Rs 5,000

Sales for the year ended 31-3-2011 was Rs 1,50,000. Tax rate 50%.

On the basis of the following information, calculate:

(i) Debt-Equity Ratio and

(ii) Working Capital Turnover Ratio

Information: Rs.

Net Sales 60,00,000

Cost of goods sold 45,00,000

Other current assets 11,00,000

Current liabilities 4,00,000

Paid up share capital 6,00,000

6% Debentures 3,00,000

9% Loan 1,00,000

Debenture Redemption Reserve 2,00,000

Closing Stock 1,00,000

From the following Balance Sheets of Vijaya Ltd. as on 31-3-2009 and 31-3-2010 prepare a Cash Flow Statement.

Liabilities

31-3-2009

(Rs)

31-3-2010

(Rs)

Assets

31-3-2009

(Rs)

31-3-2010

(Rs)

Share Capital

General Reserve

Profit & loss account

Trade Creditors

45,000

15,000

10,000

8,700

65,000

27,500

15,000

11,000

Fixed Assets

Stock

Debtors

Cash

Preliminary expense

46,700

11,000

18,000

2,000

1,000

83,000

13,000

19,500

2,500

500

78,700

1,18,500

78,700

1,18,500

Additional Information:

(i) Depreciation on Fixed Assets for the year 2009-2010 was Rs. 14,700.

(ii) An interim dividend Rs. 7,000 has been paid to the shareholders during the year.

Liabilities

31-3-2009

(Rs)

31-3-2010

(Rs)

Assets

31-3-2009

(Rs)

31-3-2010

(Rs)

Share Capital

General Reserve

Profit & loss account

Trade Creditors

45,000

15,000

10,000

8,700

65,000

27,500

15,000

11,000

Fixed Assets

Stock

Debtors

Cash

Preliminary expense

46,700

11,000

18,000

2,000

1,000

83,000

13,000

19,500

2,500

500

78,700

1,18,500

78,700

1,18,500

(i) Depreciation on Fixed Assets for the year 2009-2010 was Rs. 14,700.

(ii) An interim dividend Rs. 7,000 has been paid to the shareholders during the year.

What is meant by solvency of business?

Sponsor Area

Mock Test Series

Mock Test Series