Sponsor Area

Reconstitution Of A Partnership Firm - Admission Of A Partner

On 1-4-2010 Sahil and Charu entered into partnership for sharing profits in the ratio of 4: 3. They admitted Tanu as a new partner on 1-4-2012 for 1/5th share which she acquired equally from Sahil and Charu. Sahil, Charu and Tanu earned profits at a higher rate than the normal rate of return for the year ended 31-3-2013. Therefore, they decided to expand their business. To meet the requirements of additional capital they admitted Puneet as a new partner on 1-4-2013 for 1/7th share in profits which he acquired from Sahil and Charu in 7: 3 ratio.

Calculate:

(i) New profit sharing ratio of Sahil, Charu and Tanu for the year 2012-13.

(ii) New profit sharing ratio of Sahil, Charu, Tanu and Puneet on Puneet's admission.

Calculation of New Profit Sharing Ratio of Sahil, Charu and Tanu for the year 2012-13

Old Ratio of Sahil and Charu = 4:3

Tanu admitted for 1/5th share, acquired by her equally from Sahil and Charu

Calculation of sacrificing ratio:

Sahil = 1/5 * ½ = 1/10

Charu = 1/5 * ½ = 1/10

New Profit Share = Old Share – Sacrificing Share

Sahil: 4/7 – 1/10 = (40-7)/70 =33/70

Charu: 3/7 – 1/10 = (30-7)/70 = 23/70

And Tanu: 1/5 or 14/70

Therefore, New Profit Sharing Ratio of Sahil, Charu and Tanu = 33: 23: 14

Calculation of New Profit Sharing Ratio of Sahil, Charu, Tanu and Puneet

Old Ratio of Sahil, Charu and Tanu = 33: 23: 14

Puneet admitted for 1/7th share, acquired from Sahil and Charu in the ratio of 7: 3

Calculation of sacrificing ratio:

Sahil = 1/7 * 7/10 = 7/70

Charu = 1/7 * 3/10 = 3/70

New Profit Share = Old Share – Sacrificing Share

Sahil: 33/70 – 7/70 = 26/70

Charu: 23/70 – 3/70 = 20/70

Tanu: 14/70

Puneet = 1/7 or 10/70

Therefore, New Profit Sharing Ratio of Sahil, Charu, Tanu and Puneet = 26: 20: 14: 10

Some More Questions From Reconstitution Of A Partnership Firm - Admission Of A Partner Chapter

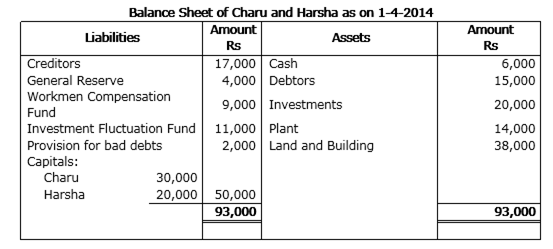

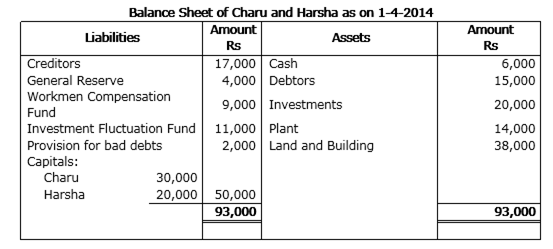

Charu and Harsha were partners in a firm sharing profits in the ratio of 3: 2. On 1-4-2014 their Balance Sheet was as follows:

On the above date Vaishali was admitted for 1/4th share in the profits of the firm on the following terms:

(a) Vaishali will bring Rs 20,000 for her capital and Rs 4,000 for her share of goodwill premium.

(b) All debtors were considered good.

(c) The market value of investments was Rs 15,000.

(d) There was a liability of Rs 6,000 for workmen compensation.

(e) Capital accounts of Charu and Harsha are to be adjusted on the basis of Vaishali's capital by opening current accounts.

Prepare Revaluation Account and Partners' Capital Accounts.

(b) All debtors were considered good.

(c) The market value of investments was Rs 15,000.

(d) There was a liability of Rs 6,000 for workmen compensation.

(e) Capital accounts of Charu and Harsha are to be adjusted on the basis of Vaishali's capital by opening current accounts.

What is meant by 'Reconstitution of a Partnership Firm'?

X, Y and Z are partners sharing profits in the ratio of 1/2, 2/5, 1/10. Find the new ratio of remaining partners if Z retires.

Saloni and Shrishti were partners in a firm sharing profits in the ratio of 7:3. Their capitals were Rs 2,00,000 and Rs 1,50,000 respectively. They admitted Aditi on 1st April, 2013 as a new partner for 1/6 share in future profits. Aditi brought Rs 1,00,000 as her capital. Calculate the value of goodwill of the firm and record necessary journal entries for the above transaction on Aditi's admission.

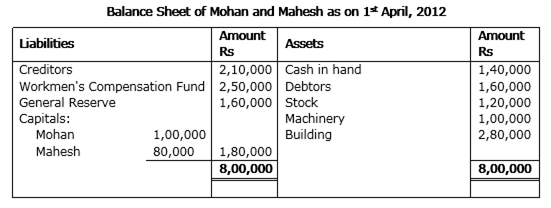

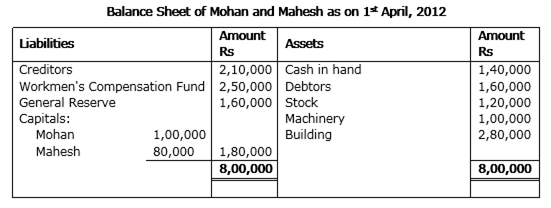

Mohan and Mahesh were partners in a firm sharing profits in the ratio of 3:2. On 1st April, 2012 they admitted Nusrat as a partner in the firm. The Balance Sheet of Mohan and Mahesh on that date was as under:

It was agreed that:

(i) The value of Building and Stock be appreciated to Rs 3,80,000 and Rs 1,60,000 respectively.

(ii) The liabilities of workmen's compensation fund was determined at Rs 2,30,000.

(iii) Nusrat brought in her share of goodwill Rs 1,00,000 in cash.

(iv) Nusrat was to bring further cash as would make her capital equal to 20% of the combined capital of Mohan and Mahesh after above revaluation and adjustments are carried out.

(v) The future profit sharing ratio will be Mohan 2 / 5, Mahesh 2/5, Nusrat 1/5.

Prepare Revaluation Account, Partner's Capital Accounts and Balance Sheet of the new firm. Also show clearly the calculation of Capital brought by Nusrat.

(i) The value of Building and Stock be appreciated to Rs 3,80,000 and Rs 1,60,000 respectively.

(ii) The liabilities of workmen's compensation fund was determined at Rs 2,30,000.

(iii) Nusrat brought in her share of goodwill Rs 1,00,000 in cash.

(iv) Nusrat was to bring further cash as would make her capital equal to 20% of the combined capital of Mohan and Mahesh after above revaluation and adjustments are carried out.

(v) The future profit sharing ratio will be Mohan 2 / 5, Mahesh 2/5, Nusrat 1/5.

Kushal Kumar and Kavita were partners in a firm sharing profits in the ratio of 3:1:1. On 1st April, 2012 their Balance Sheet was as follows:

On the above date Kavita retired and the following was agreed:

(i) Goodwill of the firm was valued at Rs 40,000.

(ii) Land was to be appreciated by 30% and building was to be depreciated by Rs 1,00,000.

(iii) Value of furniture was to be reduced by Rs 20,000.

(iv) Bad debts reserve is to be increased to Rs 15,000.

(v) 10% of the amount payable to Kavita was paid in cash and the balance was transferred to her Loan Account.

(vi) Capitals of Kushal and Kumar will be in proportion to their new profit sharing ratio. The surplus/deficit, if any in their Capital Accounts will be adjusted through Current Accounts.

Prepare Revaluation Account, Partner's Capital Accounts and Balance Sheet of Kushal and Kumar after Kavita's retirement.

(i) Goodwill of the firm was valued at Rs 40,000.

(ii) Land was to be appreciated by 30% and building was to be depreciated by Rs 1,00,000.

(iii) Value of furniture was to be reduced by Rs 20,000.

(iv) Bad debts reserve is to be increased to Rs 15,000.

(v) 10% of the amount payable to Kavita was paid in cash and the balance was transferred to her Loan Account.

(vi) Capitals of Kushal and Kumar will be in proportion to their new profit sharing ratio. The surplus/deficit, if any in their Capital Accounts will be adjusted through Current Accounts.

State the ratio in which the partners share profits or losses on revaluation of assets and liabilities, when there is a change in profit sharing ratio amongst existing partners?

Mona, Nisha and Priyanka are partners in a firm. They contributed Rs. 50,000 each as capital three years ago. At that time Priyanka agreed to look after the business as Mona and Nisha were busy. The profits for the past three years were Rs. 15,000, Rs. 25,000 and Rs. 50,000 respectively. While going through the books of accounts Mona noticed that the profit had been distributed in the ratio of 1 : 1 : 2. When the enquired from Priyanka about this, Priyanka answered that since she looked after the business she should get more profit. Mona disagreed and it was decided to distribute profit equally retrospectively for the last three years.

(a) You are required to make necessary corrections in the books of accounts of Mona, Nisha and Priyanka by passing an adjustment entry.

(b) Identify the value which was not practiced by Priyanka while distributing profits.

(a) You are required to make necessary corrections in the books of accounts of Mona, Nisha and Priyanka by passing an adjustment entry.

(b) Identify the value which was not practiced by Priyanka while distributing profits.

Abhay and Beena are partners in a firm. They admit Chetan as a partner with 1/4th shares in the profits of the firm. Chetan brings Rs. 2,00,000 as his share of capital. The value of the total assets of the firm is Rs. 5,40,000 and outside liabilities are valued at Rs. 1,00,000 on that date. Give the necessary entry to record goodwill at the time of Chetan's admission. Also show your working notes.

Naresh, David and Aslam are partners sharing profits in the ratio of 5:3:7. On April 1st, 2012, Naresh gave a notice to retire from the firm. David and Aslam decided to share future profits in the ratio of 2:3. The adjusted capital accounts of David and Aslam show a balance of Rs. 33,000 and Rs. 70,500 respectively. The total amount to be paid to Naresh is Rs. 90,500. This amount is to be paid by David and Aslam in such a way that their capitals become proportionate to their new profit sharing ratio. Pass necessary journal entries for the above transactions in the books of the firm. Show your working clearly.

Sponsor Area

Mock Test Series

Mock Test Series