CBSE accountancy

Sponsor Area

Durga and Naresh were partners in a firm. They wanted to admit five more members in the firm. List any two categories of individuals other than minors who cannot be admitted by them.

The following persons other than Minor, cannot be admitted to a Partnership

(a) Persons disqualified by any law

(b) Persons of Unsound mind

Sponsor Area

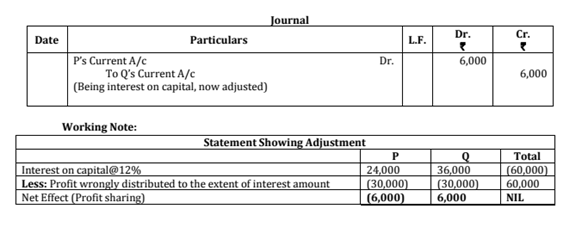

P and Q were partners in a firm sharing profits and losses equally. Their fixed capitals were ₹ 2,00,000 and ₹ 3,00,000 respectively. The partnership deed provided for interest on capital @ 12% per annum. For the year ended 31st March, 2016, the profits of the firm were distributed without providing interest on capital. Pass necessary adjustment entry to rectify the error.

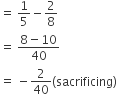

A and B were partners in a firm sharing profits and losses in the ratio of 5:3. They admitted C as a new partner. The new profit sharing ratio between A, B and C was 3 : 2 : 3. A surrendered  th of his share in favour of C. Calculate B's sacrifice.

th of his share in favour of C. Calculate B's sacrifice.

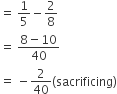

B's Sacrifice = Old Share - New Share

B's Sacrifice =

B's Sacrifice =

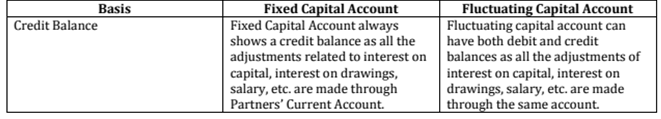

Distinguish between ‘Fixed Capital Account’ and ‘Fluctuating Capital Account’ on the basis of credit balance.

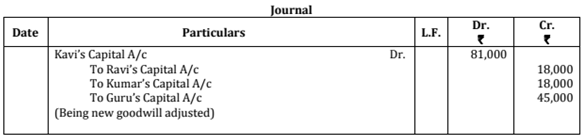

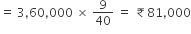

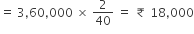

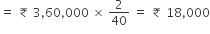

Kavi, Ravi, Kumar and Guru were partners in a firm sharing profits in the ratio of 3:2:2:1. On 1.2.2017, Guru retired and the new profit sharing ratio decided between Kavi, Ravi and Kumar was 3:1:1. On Guru’s retirement the goodwill of the firm was valued at ₹ 3,60,000.

Showing your working notes clearly, pass necessary journal entry in the books of the firm for the treatment of goodwill on Guru’s retirement.

Working Note:

Kavi

Ravi

Kumar

Goodwill valued = ₹ 3,60,000

Kavi

Ravi

Kumar

Guru

Sponsor Area

Mock Test Series

Mock Test Series