CBSE accountancy

Sponsor Area

What is the maximum number of partners that a partnership firm can have? Name the Act that provides for the maximum number of partners in a partnership firm.

A partnership firm can have minimum two and maximum 50 partners as per the new Companies Act, 2013 and vide Rule 10 of the companies (Miscellaneous) Rules, 2014.

Sponsor Area

A, B and C were partners in a firm sharing profits in the ratio of 3:2:1. They admitted D as a new partner for 1/8th share in the profits, which he acquired 1/16th from B and 1/16th from C. Calculate the new profits sharing ratio of A,B, C and D.

Profit Sharing Ratio of A, B and C = 3:2:1

Distinguish between 'Dissolution of Partnership' and 'Dissolution of Partnership Firm on the basis of 'Economic Relationship'.

On the basis of Economic Relationship, the difference is given below:

In Dissolution of Partnership, Economic relationship continues and changes between the partners while in Dissolution of Firm, Economic Relationship ends amongst all the partners.

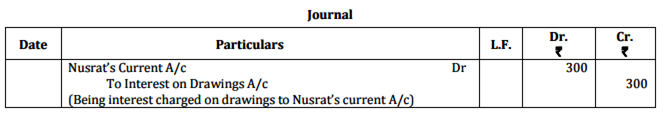

Nusrat and Sonu were partners in a firm sharing profits in the ratio of 3:2. During the year ended 31-3-2015 Nusrat had withdrawn Rs 15,000. Interest on her drawings amounted to Rs 300. Pass necessary journal entry for charging interest on drawing assuming that the capitals of the partners were fixed.

State any three circumstances other than (i) admission of a new partner; (ii) retirement of a partner and (iii) death of a partner, when need for valuation of goodwill of a firm may arise.

Valuation of goodwill also arises in the following cases:

(i) When the partnership firm is sold to some other concern on going concern basis.

(ii) When two firms amalgamate that is merger or acquisition of two businesses.

(iii) When the existing partners in the firm jointly agree to change the profit sharing ratio between them.

Sponsor Area

Mock Test Series

Mock Test Series