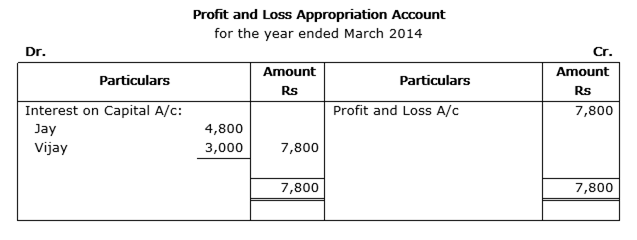

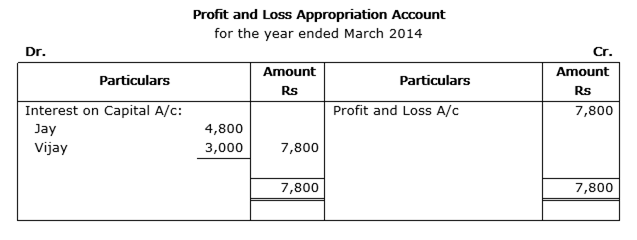

On 1-4-2013 Jay and Vijay, entered into partnership for supplying laboratory equipment’s to government schools situated in remote and backward areas. They contributed capitals of Rs 80,000 and Rs 50,000 respectively and agreed to share the profits in the ratio 3: 2. The partnership deed provided that interest on capital shall be allowed at 9% per annum. During the year the firm earned a profit of Rs 7,800.

Showing your calculations clearly, prepare 'Profit and Loss Appropriation Account' of Jay and Vijay for the year ended 31-3-2014.

Solution

Short Answer

Working Notes:

Calculation of Interest on Capital

Interest on Jay’s capital = 80000*9/100=7200 Rs

Interest on Vijay’s capital = 50,000*9/100 = 4500 Rs

Total interest = 7200+4500 = Rs 11,700

Calculation of proportionate Interest on capital

Jay: (7200/11700)*7800 = Rs 4800

Vijay: (4500/11700) * 7800 = Rs 3000