CBSE accountancy

Sponsor Area

In the absence of partnership deed the profits of a firm are divided among the partners:

(a) In the ratio of capital

(b) Equally

(c) In the ratio of time devoted for the firm's business

(d) According to the managerial abilities of the partners

(b) Equally: According to partnership act 1932, in the absence of any partnership deed, profits of the firm are divided among the partners equally.

Sponsor Area

A, B, C and D were partners in a firm sharing profits in the ratio of 4:3:2:1. On 1-1-2015 they admitted E as a new partner for 1:10 share in the profits. E brought Rs 10,000 for his share of goodwill premium which was correctly recorded in the books by the accountant. The accountant showed goodwill at Rs 1,00,000 in the books. Was the accountant correct in doing so? Give reason in support of your answer.

According to AS 26, good will can be shown in books of accounts only when it is purchased. Otherwise, it should be immediately distributed among the old partners in their sacrificing ratio. Hereby showing it in the books of accounts, accountant has violated the law and made wrong accounting entry and hence he cannot be supported.

On the retirement of Hari from the firm of 'Hari, Ram and Sharma' the balance-sheet showed a debit balance of Rs 12,000 in the profit and loss account. For calculating the amount payable to Hari this balance will be transferred

(a) to the credit of the capital accounts of Hari, Ram and Sharma equally

(b) to the debit of the capital accounts of Hari, Ram and Sharma equally

(c) to the debit of the capital accounts of Ram and Sharma equally

(d) to the credit of the capital accounts of Ram and Sharma equally

Answer is option b. Since at the time of retirement of a partner, the profit and loss account balance is transferred to the old partner’s capital account in their old profit sharing ratio, the debit balance of profit and loss account is to be transferred to the debit of the capital accounts of Hari, Ram and Sharma equally.

Kumar, Verma and Naresh were partners in a firm sharing profit & loss in the ratio of 3: 2: 2. On 23rd January, 2015 Verma died. Verma's share of profit till the date of his death was calculated at Rs 2,350.

Pass necessary journal entry for the same in the books of the firm.

| Date | Particulars | L.F. | Debit(Rs.) | Credit (Rs.) |

Profit and Loss Suspense A/C Dr. To Verma's Capital A/C (Verma's share of Profit transferred to his Capital Account) |

2350 | 2350 |

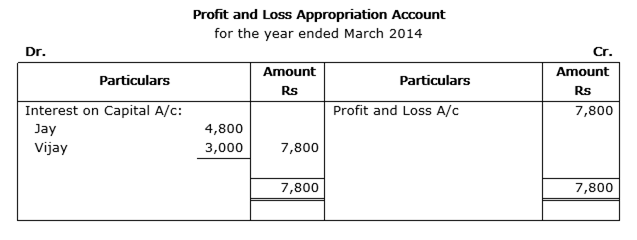

On 1-4-2013 Jay and Vijay, entered into partnership for supplying laboratory equipment’s to government schools situated in remote and backward areas. They contributed capitals of Rs 80,000 and Rs 50,000 respectively and agreed to share the profits in the ratio 3: 2. The partnership deed provided that interest on capital shall be allowed at 9% per annum. During the year the firm earned a profit of Rs 7,800.

Showing your calculations clearly, prepare 'Profit and Loss Appropriation Account' of Jay and Vijay for the year ended 31-3-2014.

Working Notes:

Calculation of Interest on Capital

Interest on Jay’s capital = 80000*9/100=7200 Rs

Interest on Vijay’s capital = 50,000*9/100 = 4500 Rs

Total interest = 7200+4500 = Rs 11,700

Calculation of proportionate Interest on capital

Jay: (7200/11700)*7800 = Rs 4800

Vijay: (4500/11700) * 7800 = Rs 3000

Sponsor Area

Mock Test Series

Mock Test Series