CBSE accountancy

Sponsor Area

What is meant by 'Reconstitution of a Partnership Firm'?

In a partnership firm, any change in the existing agreement between the partners amounts to its reconstitution. It leads to the end of the existing agreement and a new agreement comes into being with a changed relationship among the members of the partnership firm.

Sponsor Area

X, Y and Z are partners sharing profits in the ratio of 1/2, 2/5, 1/10. Find the new ratio of remaining partners if Z retires.

Old profit sharing ratio =1/2, 2/5, 1/10 =5:4:1 (by taking 10 as LCM)

As Z retires, the new profit sharing ratio will be 5: 4.

Distinguish between 'Dissolution of Partnership' and Dissolution of Partnership Firm' on the basis of closure of books.

Following is the difference between dissolution of partnership and dissolution of a partnership firm.

|

Basis of Difference |

Dissolution of Partnership |

Dissolution of Partnership Firm |

|

Settlement of Assets and liabilities |

Assets and liabilities are revalued and new balance sheet is prepared. |

Assets are sold and liabilities are paid off. |

Why heirs of a retiring/deceased partner are entitled to a share of goodwill of the firm?

The retiring partner / heirs of deceased partner are entitled to his share of goodwill because the goodwill earned by the firm is the result of the efforts of all the existing partners in the past. As they will not be sharing future profits, it will be fair to compensate them for the same.

Saloni and Shrishti were partners in a firm sharing profits in the ratio of 7:3. Their capitals were Rs 2,00,000 and Rs 1,50,000 respectively. They admitted Aditi on 1st April, 2013 as a new partner for 1/6 share in future profits. Aditi brought Rs 1,00,000 as her capital. Calculate the value of goodwill of the firm and record necessary journal entries for the above transaction on Aditi's admission.

Aditi is admitted for 1/6th share of profit, for capital amounting to Rs 100000.

Capitalized value of firm on the basis of Aditi’s capital = 100000*6/1=600000.

Actual capital = 200000+150000+100000=450000.

Value of goodwill = 600000-450000= 150000.

Aditi’s share in goodwill = 1/6th of 1,50,000 = Rs 25,000

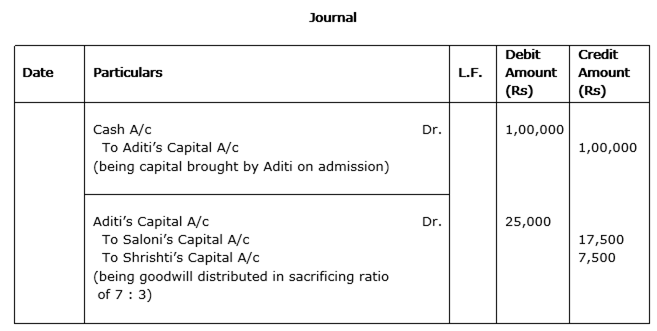

The journal entries are as follows:

Sponsor Area

Mock Test Series

Mock Test Series