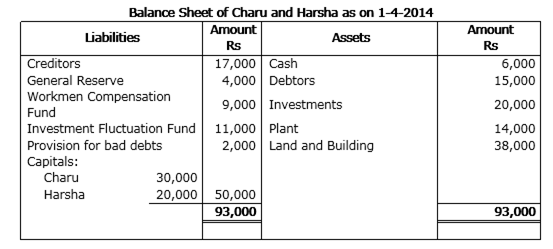

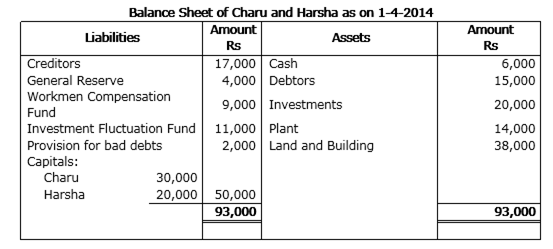

Charu and Harsha were partners in a firm sharing profits in the ratio of 3: 2. On 1-4-2014 their Balance Sheet was as follows:

(a) Vaishali will bring Rs 20,000 for her capital and Rs 4,000 for her share of goodwill premium.

(b) All debtors were considered good.

(c) The market value of investments was Rs 15,000.

(d) There was a liability of Rs 6,000 for workmen compensation.

(e) Capital accounts of Charu and Harsha are to be adjusted on the basis of Vaishali's capital by opening current accounts.

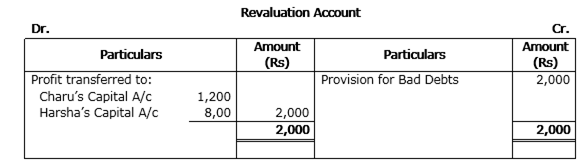

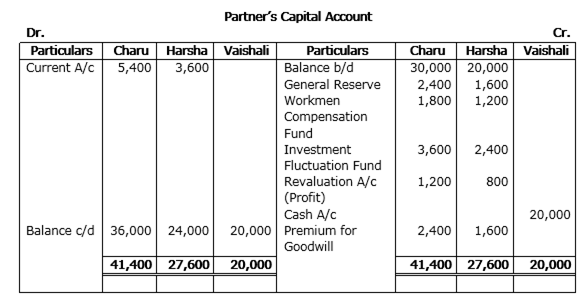

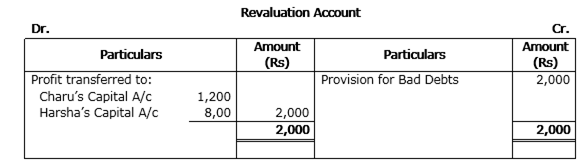

Prepare Revaluation Account and Partners' Capital Accounts.

Working Notes:

Calculation of new profit sharing ratio:

Old profit sharing ratio = 3:2

Vaishali is admitted for 1/4th share.

Hence profit share available to old partners are 1-1/4=3/4

Charu’s new profit share= 3/5*3/4=9/20

Harsha’s new profit share = 2/5*3/4=6/20

Vaishali’s =1/4=5/20

Hence new profit sharing ratio= 9:6:5

Calculation of sacrificing ratio:

Old Ratio= 3:2

New ratio=9:6:5

Hence sacrificing ratio= old ratio – new ratio

Charu’s =3/5-9/20=3/20

Harsha’s =2/5-6/20=2/20

Sacrificing ratio= 3:2

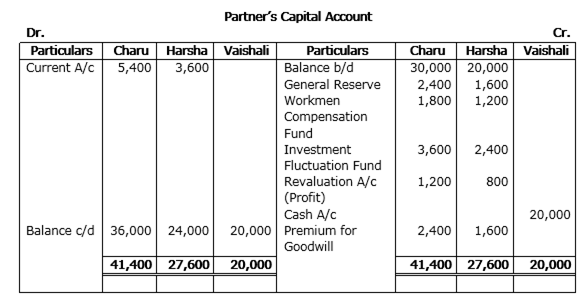

Distribution of goodwill:

Goodwill brought in =Rs 4,000

Charu’s share =4,000*3/5=2,400 Rs

Harsha’s share = 4000*2/5=1600 Rs

Adjustment of Capital:

Total capital of the firm = Capitalising Vaishali’s capital

=20,000*4/1 = Rs 80,000

New profit sharing Ratio = 9:6:5

Charu’s new capital =80000*9/20=36,000 Rs

Harsha’s new capital = 80,000*6/20= 24,000 Rs

Vaishali’s new capital = 20,000 Rs

Working Notes:

Calculation of new profit sharing ratio:

Old profit sharing ratio = 3:2

Vaishali is admitted for 1/4th share.

Hence profit share available to old partners are

1-1/4=3/4

Charu’s new profit share= 3/5*3/4=9/20

Harsha’s new profit share = 2/5*3/4=6/20

Vaishali’s =1/4=5/20

Hence new profit sharing ratio= 9:6:5

Calculation of sacrificing ratio:Old Ratio= 3:2

New ratio=9:6:5

Hence sacrificing ratio= old ratio – new ratio

Charu’s =3/5-9/20=3/20

Harsha’s =2/5-6/20=2/20

Sacrificing ratio= 3:2

Distribution of goodwill:Goodwill brought in =Rs 4,000

Charu’s share =4,000*3/5=2,400 Rs

Harsha’s share = 4000*2/5=1600 Rs

Adjustment of Capital:Total capital of the firm = Capitalising Vaishali’s capital =20,000*4/1 = Rs 80,000

New profit sharing Ratio = 9:6:5

Charu’s new capital =80000*9/20=36,000 Rs

Harsha’s new capital = 80,000*6/20= 24,000 Rs

Vaishali’s new capital = 20,000 Rs