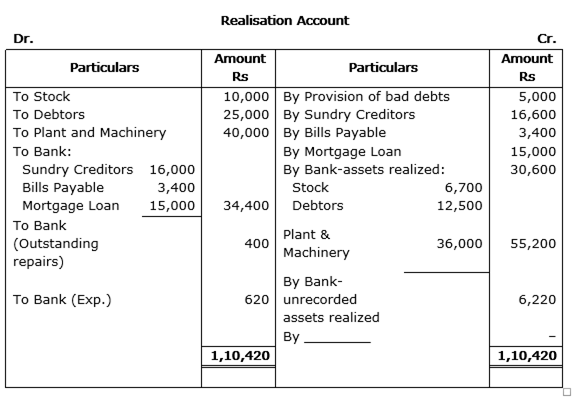

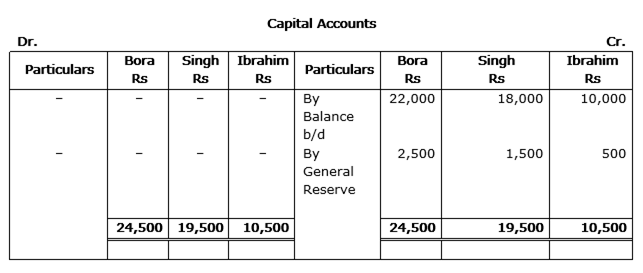

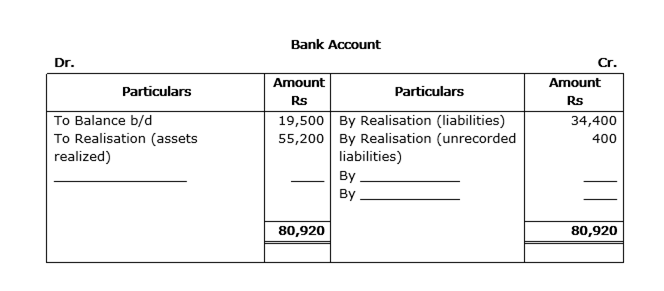

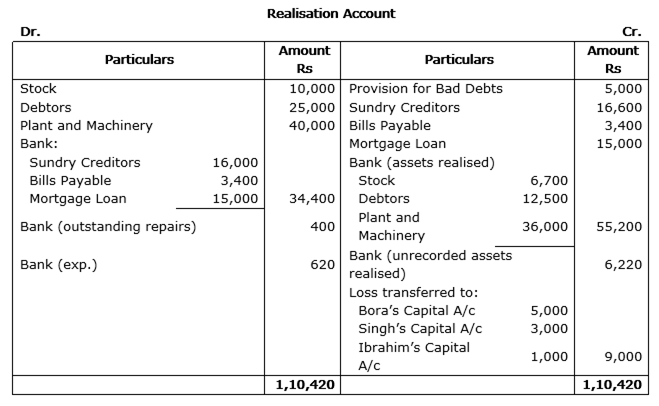

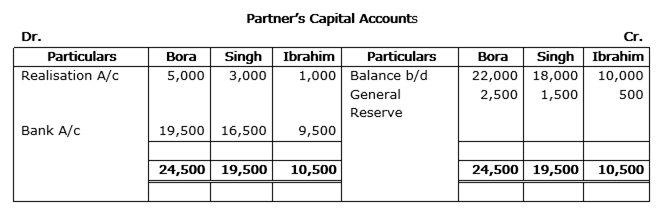

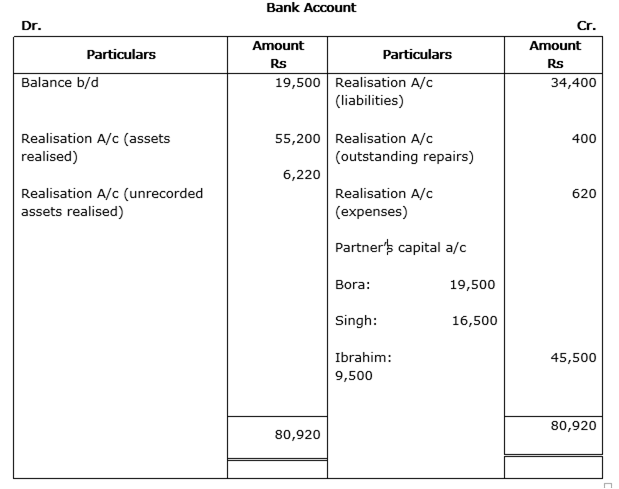

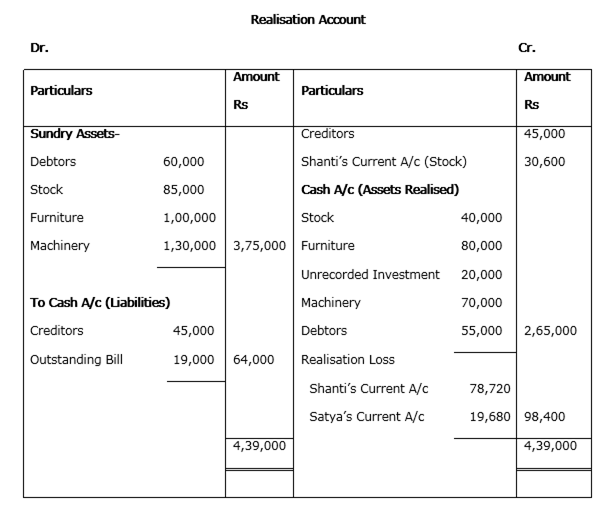

Bora, Singh and Ibrahim were partners in a firm sharing profits in the ratio of 5: 3: 1. On 2-3-2015 their firm was dissolved. The assets were realized and the liabilities were paid off. Given below are the Realisation Account, Partners' Capital Account and Bank Account of the firm. The accountant of the firm left a few amounts unposted in these accounts. You are required to complete these accounts by posting the correct amounts.